In 2013 the Government announced its two-pronged Help to Buy scheme – this aims to address the lack of mortgage finance in the market and increase supply by increasing effective demand.

The first part of Help to Buy – Equity Loan – has been hugely successful in boosting output. It was established with three objectives:

- Increase the supply of low-deposit mortgages for credit worthy households

- Increase the supply of new housing

- Contribute to economic growth

Between April 2013 and June 2017, 134,558 households bought a new home through the equity loan scheme, of which 108,620 households were purchasing their first home. Based on average home purchasers, we estimate that well over 200,000 individuals have bought their home with support from Help to Buy.

In October 2017, Chancellor, Philip Hammond announced an additional £10bn for the scheme to ensure that its success does not result in the pre-existing budget being entirely depleted before its conclusion which is currently scheduled for March 2021.

There has been real appetite for this part of Help to Buy and housing starts have increased in response.

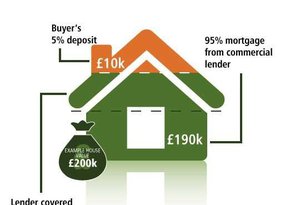

The second part of Help to Buy – Mortgage Guarantee – was due to be introduced to the market in January 2014, however, the Treasury brought the scheme forward so it was available from October 2013. Natwest, RBS, Halifax and HBOS were the first lenders to begin offering mortgages under the policy. This phase of Help to Buy was applicable to both new builds and second hand homes. The Mortgage Guarantee scheme was closed to new loans in December 2016.

On the launch of the scheme the then Prime Minister, David Cameron, said:

“Too many hardworking people are finding it impossible to buy their own home - people who can afford the monthly mortgage payments but haven’t got rich parents and can’t pay the deposit up front.”

“There is a need for Government to act. Buying your first home is about far more than four walls to sleep at night. It’s somewhere to put down roots and raise a family. It’s an investment for the future. Above all, it’s a sign that everything you’ve put in has been worth it.”

For Builders:

- Click here to sign up for the scheme on the Homes England website.