Planning permissions for new home building projects plummets to new low

Updated 9 June: Please note following a correction to the supplied data, our report and the below release was updated on 9 June 2025.

Figures starkly illustrate the urgent need for government to tackle ongoing barriers to delivery and address housing market issues

The number of new home building sites given planning approval in England during Q1 2025 was the lowest since reporting began some 20 years ago, representing less investment in new sites than during the Global Financial Crisis and the COVID-19 lockdowns.

The figures are included in the latest Housing Pipeline report from the Home Builders Federation, based on data from Glenigan.

Approval was given for just 2,064 sites in Q1, a 16% drop on the previous quarter. The rolling annual number of projects approved in the year to Q1 2025 was 9,342, itself a new record low and is the twelfth quarter in a row that the annual rolling number has been the lowest since the report began recording

In total approval for just 45,521 new homes was given in Q1 – the lowest number of quarterly approvals since 2012, a 37% drop on the previous quarter and 21% drop on Q1 2024. The report starkly illustrates the urgent need for Government to address problems in the housing market and the ongoing barriers to housing supply if they are to get anywhere near the much vaunted 1.5 million homes target.

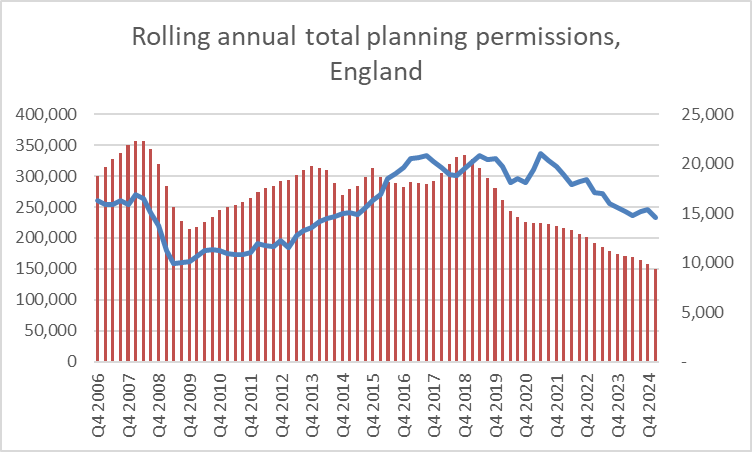

The rolling annual number of units approved in the year to Q1 2025 was just 233,695, a 5% drop on the previous 12-month period and the lowest 12-monthly outturn recorded since 2014. The figure is just 63% of the 370,000 number the Government has cited an ambition to achieve through cumulative local authority housing targets across the country.

Estimates suggest that we are currently delivering around 200,000 new homes a year, meaning that as we approach the anniversary of the election we are already 100,000 behind the run rate needed to hit the 1.5m target. With housing construction levels flatlining at best and planning permissions for new sites and new homes continuing to fall, the likelihood of imminent increases seems remote.

As the industry has been warning ministers for some time now, whilst the planning system changes announced swiftly following the election were very welcome, housing supply is determined by several key factors. Without further policy interventions in those other areas to address the huge constraints that remain, the industry is unable to deliver on Government’s - or indeed its own – wishes to build more homes.

Neil Jefferson, Chief Executive at the Home Builders Federation, said: “The latest planning figures are disastrous for an industry and a Government looking to increase housing supply over the coming years. With current supply flatlining and permissions for homes to be built over the next few years plummeting, unless urgent interventions are made, there seems little chance of us building the homes we know are desperately needed.

“Whilst the government’s ambition and the swift action on planning were very welcome, increasing housing delivery requires much more than good intentions and planning reform.

“Ministers have to address the fact that potential home owners are unable to buy due to the lack of affordable mortgage lending and the absence for the first time in decades of any Government support scheme (for first time buyers). Similarly, it needs to ensure Housing Associations are financially able to purchase the affordable homes house builders deliver. Without a functioning market for private or affordable homes it is impossible for industry to deliver them.

“Planning permissions and house building levels will not increase unless ministers work with industry and tackle the issues preventing companies from pressing the accelerator and investing in the sites, skills and supply chains needed build the homes the country needs.”

Allan Wilen, Economics Director at Glenigan, said: “The drop in detailed planning approvals has been widespread, but especially marked for larger projects of 125 homes or more. Whilst Glenigan has seen an increase in planning applications in recent months, the current decline appears to reflect earlier declines in planning applications during 2023 and the first half of last year. This underlines the long lead time to secure residential planning consent and the need to streamline the planning system.”

Industry has been clear with government that without action on a number of fronts, the welcome ambition of the 1.5m homes target will soon become an impossible dream. Specifically, ministers have been encouraged to:

- Bring forward effective support for first-time buyers. With uncertainty in the market and affordability stretched to breaking point, the effective demand for housing is extremely small and, for first-time buyers, often limited to those with wealthy families capable of providing financial assistance. Previous governments for the past 25 years have assisted first-time buyers with equity loans or shared equity mortgage support and for more than 60 years governments have supported home ownership in other ways. A recent report by Public First found that introducing a new equity loan scheme for first-time buyers would support the construction of an additional 100,000 new homes over the next five years;

- Address the long-term problems in the Section 106 Affordable Housing market which see tens of thousands of new homes designated for Social and Affordable Rents going unacquired by Housing Associations. Improving flexibility in Section 106 agreements to clear the backlog and get builders investing again is long overdue;

- Resolve the ongoing delays and uncertainty caused by the failure of the Building Safety Regulator to meet its service requirements. Since last spring, prospective high rise developments have required approval from the new Regulator run by the Health and Safety Executive which has been unable to deal with its workload. Investment in new apartment blocks has collapsed because of the uncertainty;

- Speed up the planning process. While the planning framework changes delivered by the government in its first months have helped to create a more progressive planning system, the day-to-day operation of planning services at a local level continues to frustrate. Recent HBF research has found a shortfall of more than 2,000 planners in local authority departments and average times to agree a Section 106 agreement is regularly exceeded one year. Meanwhile, stretch councils are failing to spend infrastructure and community payments made by developers with the running total of unspent Section 106 and Community Infrastructure Levy reaching £8bn in 2024;

- Recognise the impact that a suite of new taxes, levies and policy costs is having on the viability and deliverability of new housing. Since 2020, builders have seen costs of government interventions balloon with a new industry-specific Residential Property Developers Tax, Biodiversity Net Gain, Nutrient Neutrality charges and multiple regulatory changes, including a forthcoming Future Homes Standard. Government recently confirmed the introduction next year of a new levy on house building, which will add thousands to the cost of building each new home, and last week launched a consultation on a new Build Out Tax, empowering councils to impose additional costs on builders if construction rates decline due to market slowdowns.

ENDS

For media enquiries, or to arrange an interview, contact HBF’s communications team at media@hbf.co.uk or call Steve Turner on 07919307760

Notes to editors

- The Home Builders Federation (HBF) is the principal representative body for private sector home builders and voice of the home building industry in England and Wales. HBF member firms account for some 80% of all new homes built in England and Wales in any one year, and include companies of all sizes, ranging from widely recognised national firms, through regionally based businesses and small local companies: hbf.co.uk

- Glenigan, powered by Hubexo, is the trusted provider of UK construction project data, market analysis and company intelligence. Combining comprehensive information gathering with expert analysis, it delivers timely insight into UK construction activity. Glenigan customers include government agencies, construction companies and suppliers of materials and services to the industry: Glenigan.com