Last updated: 9 Dec 2025

State of Play 2025/26

Challenges and opportunities facing small- and medium-sized home builders.

Downloads

SME: State of Play Report

Contents

- Foreword

- Introduction

- Methodology

- Barriers to growth

- Planning process

- Section 106 Affordable Housing Market

- Viability

- Building Safety Levy

- Biodiversity Net Gain

- Costs of essentials: Land, labour and materials

- Market

- Infrastructure

- Business outlook

- Recommendations and conclusions

Foreword

Neil Jefferson, Chief Executive, the Home Builders Federation (HBF)

Over the past two decades, the operating environment for SME home builders has become steadily more challenging. The 2025 State of Play report marks the sixth iteration of this report, yet the findings remain as shocking as ever. Throughout every one of these reports, issues associated with planning delays have remained the top barriers to growth for SMEs.

I therefore welcomed the Government’s announcements regarding the planning system made shortly after the election, and in the long term, the National Planning Policy Framework (NPPF) changes and introduction of the grey belt will help ease some of the delays that developers currently face. However, the complexity and cost of the planning process have yet to be addressed in any meaningful way.

For many SME builders, navigating the system remains an arduous and expensive undertaking, with disproportionate administrative burdens and unpredictable outcomes. These challenges not only stifle growth but also deter new entrants from joining the sector altogether.

At a time when housing delivery targets are under increasing scrutiny, it is vital that policymakers focus on creating a more transparent, proportionate, and efficient planning framework – one that genuinely supports smaller developers. Simplifying local plan processes, improving consistency in decision-making, and investing in local authority planning capacity would be important first steps. Beyond planning, it is critical that SME organisations can confidently invest in future land and labour supply.

Issues with viability, infrastructure delays and increasing demand-side challenges limit their capacity to plan and deliver new projects. Without meaningful reform, smaller builders will remain at a disadvantage, increasingly squeezed out by larger developers who can more easily absorb the delays and costs.

This imbalance risks reducing competition, slowing housing delivery, and eroding the unique local character that SME builders bring to communities, directly undermining the Government’s goal of creating a diverse and resilient housing market.

Phil Hooper, Chief Executive, Close Brothers Property Finance

The Government’s commitment to widescale reform of the planning system from day one sent a welcome signal that housing delivery would be at the top of the agenda. However, a year and a half later, progress has been slow and for many SME housebuilders, the benefits are yet to be felt on the ground.

Across the country, schemes continue to be delayed by extensive backlogs in local planning authorities, a situation which has been exacerbated by the ongoing challenges of implementing Biodiversity Net Gain requirements and meeting affordable housing obligations. These policies, while well-intentioned, are contributing to mounting delays and rising costs, often hitting smaller builders the hardest.

At the same time, market conditions have become increasingly difficult. Affordability constraints, particularly for first-time buyers, combined with the absence of Government support, are making it harder for SME developers to sell existing stock. With these combined pressures it is little surprise that more than half of the SMEs surveyed in this report feel less optimistic about their prospects than they did a year ago.

Despite this, I remain inspired by the determination and resilience of the SME home builders. As a lender working closely with these businesses, we see first-hand the commitment of SMEs to their communities, and their ability to deliver high-quality, small and medium-sized schemes that larger housebuilders often overlook.

Their contribution to housing delivery, placemaking, and local employment is invaluable, yet they are forced to operate in a system that too often works against them. The State of Play report highlights not just the challenges facing SME housebuilders but also the significant untapped potential within the sector. If the Government is serious about boosting housing supply, there must be a renewed focus on removing the disproportionate burdens faced by SMEs.

With the right support, be it through meaningful planning reform, exemptions for small sites from Biodiversity Net Gain requirements, or targeted market interventions, SMEs have the potential to play a far greater role in delivering the new homes our country urgently needs. In fact, SMEs are confident that if the barriers detailed in this report are effectively addressed, they could substantially increase their housing output.

We are proud to produce this report alongside the Home Builders Federation and Travis Perkins and hope that parliamentarians and policymakers will give serious consideration to the concerns and recommendations that it outlines.

Ben Todd, Managing Director, Travis Perkins Managed Services

This, the sixth edition of the State of Play report, highlights the same pressures that have challenged SME home builders year after year: planning delays, under-resourced local authorities, and a regulatory environment that too often adds cost and complexity rather than enabling delivery. These issues continue to weigh most heavily on smaller developers, who lack the scale to absorb rising taxes, Section 106 challenges and the forthcoming Building Safety Levy.

In contrast, only 10% of respondents cite supply chain and material availability as a major barrier, significantly down from 78% in 2021 when Travis Perkins first became involved with the survey. Whilst I remain nervous that any sizable shift in build volumes could create strain on what remains a fragile supply chain, we’d welcome the challenge.

At Travis Perkins, we have also adapted to play our part in supporting SME home builders, evolving beyond being a materials supplier to offer services and solutions that give SMEs the confidence to keep building - support with finance, tailored managed services, and access to products and expertise across the UK. Despite the challenges SMEs face, there are reasons for cautious optimism in the medium term.

The Government has set an ambitious target of 1.5 million homes and has begun to introduce reforms that will directly address SME concerns - streamlining planning for small sites, changing biodiversity rules, and focusing more strongly on land release and financing. If these measures are implemented with urgency and consistency, they could make a genuine difference.

For now, however, SMEs are not yet seeing the promised improvements on the ground.

SMEs remain central to the housing market. They create choice, bring investment into local communities, and often deliver higher standards of quality and sustainability than regulation demands. With the right environment, they can scale up quickly and play a decisive role in meeting housing needs. This report makes one point clear: SMEs are willing and ready to build more. The challenge now is to turn policy intent into visible impact, so that smaller developers feel the benefit of change and can get on with the job of delivering the homes our communities need.

Introduction

The 2025 edition of the State of Play report marks the sixth iteration of this comprehensive survey of small and medium-sized (SME) home builders, carried out by the Home Builders Federation (HBF), Close Brothers Property Finance, and Travis Perkins.

This year’s report comes at a critical moment, as the Government seeks to increase delivery to meet its 1.5 million new homes target by the end of the Parliament. Earlier in 2025, the Government also announced a package of measures to support SME developers, including proposals to improve decision making in the planning process by introducing a national scheme of delegation, a medium sites threshold, and reforms to Biodiversity Net Gain (BNG) requirements.

However, much more support from Government is needed. As with the past five editions of this report, several systemic and long-standing issues remain unresolved, including delays in the planning process, support for first time buyers, and the cumulative burden of taxes and regulation. Furthermore, the number of challenges facing SME home builders has continued to grow.

The Government’s decision to press ahead with the Building Safety Levy in 2026, which will disproportionately affect SMEs, coupled with the growing challenges in the Section 106 Affordable Housing Market, are just two of the factors making the operating environment more difficult.

As a result, more than half of SME developers say they are less optimistic than they were prior to the General Election. This report explores these challenges in more detail and highlights the areas where Government support for SME home builders is most critical.

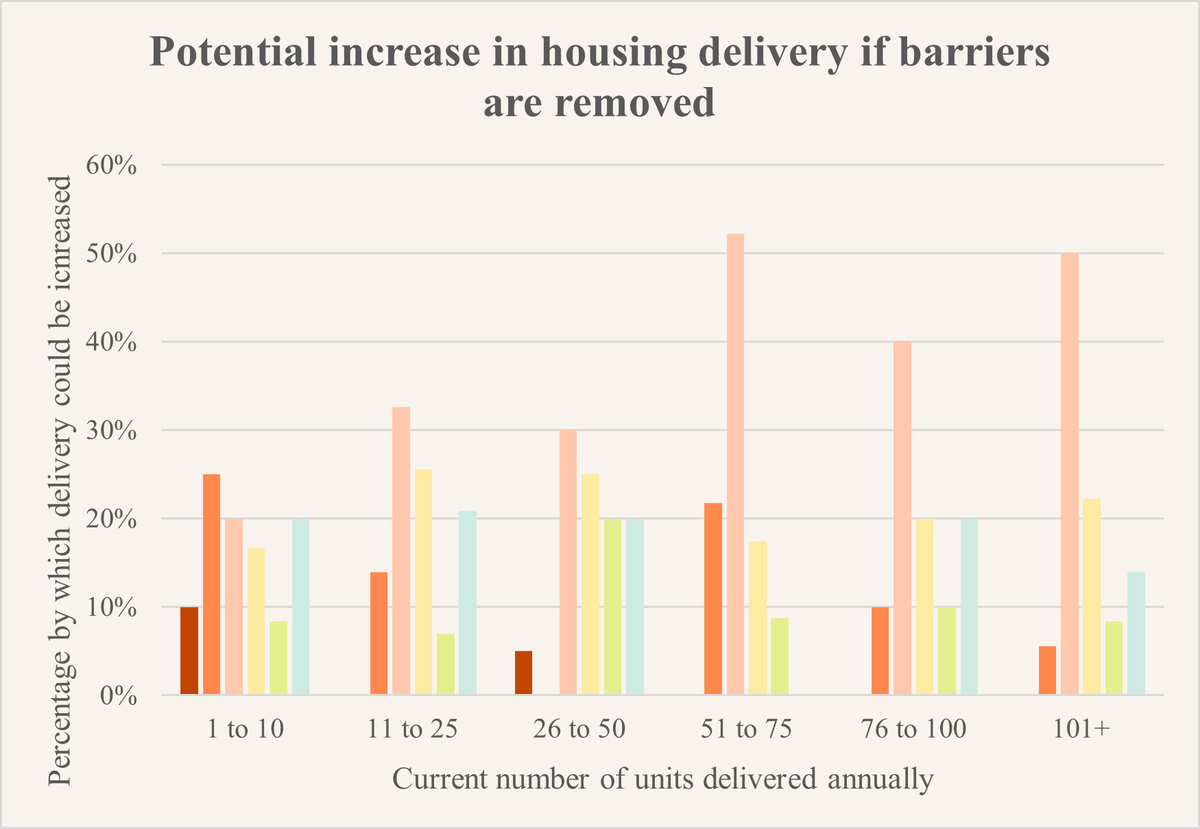

As the report outlines, if these barriers are addressed, the vast majority of SME developers say they could substantially increase the number of homes that they build each year – making a vital contribution to the 1.5 million homes ambition, and delivering diverse, high-quality new homes for local communities.

Methodology

This report is a based on the results of a comprehensive online questionnaire distributed to senior representatives of SME home builders who are either members of the HBF or clients of Travis Perkins or Close Brothers Property Finance.

A total of 225 respondents carried out the survey between 21 May and 18 June 2025 with a 76% completion rate.

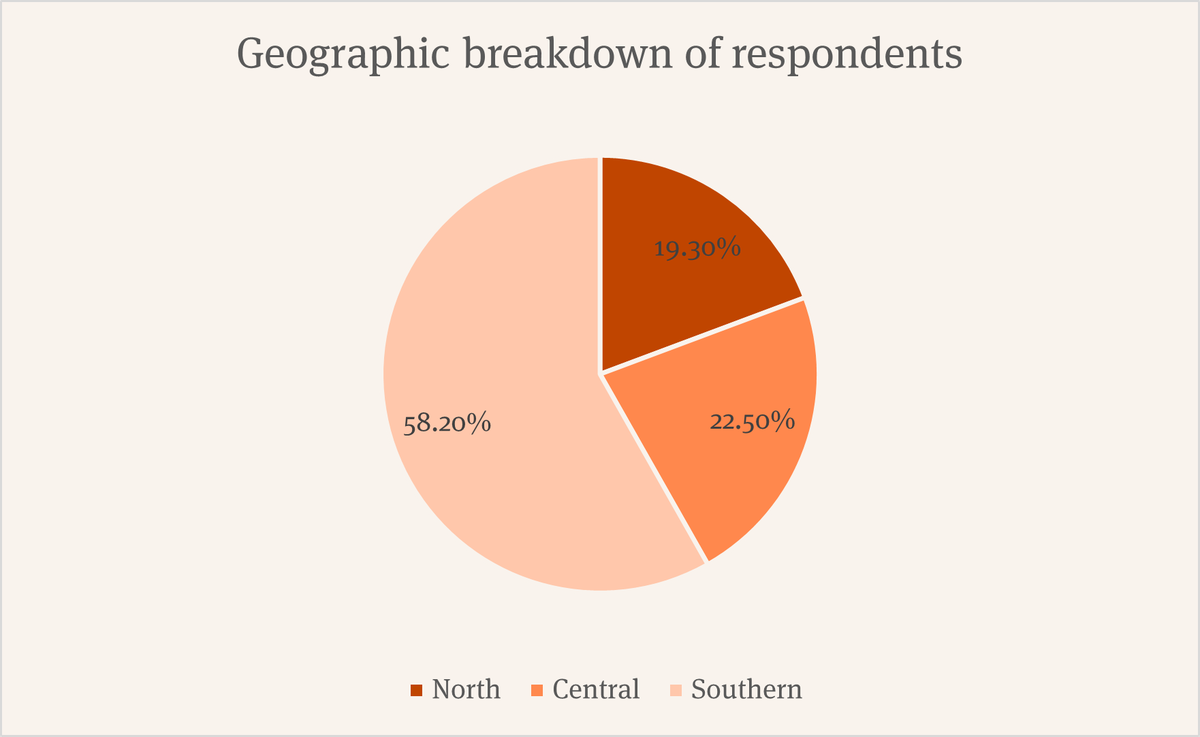

Regional split

Developers from all English regions and Scotland participated in the survey. However, no responses were received from Northern Ireland, and only a single response came from a developer in Wales.

| Region | Percentage |

|---|---|

| London | 8% |

| South East | 38% |

| East of England | 6% |

| Midlands | 16% |

| North West | 8% |

| North East | 1% |

| Yorkshire and the Humber | 8% |

| South West | 12% |

| Scotland | 2% |

| Northern Ireland | 0% |

| Wales | 0% |

As in previous years, for the purposes of this report, the regions have been grouped as follows:

- North: North West, North East, Yorkshire, and Scotland

- Central: Midlands, East of England, and Wales

- South: South East, South West, and London

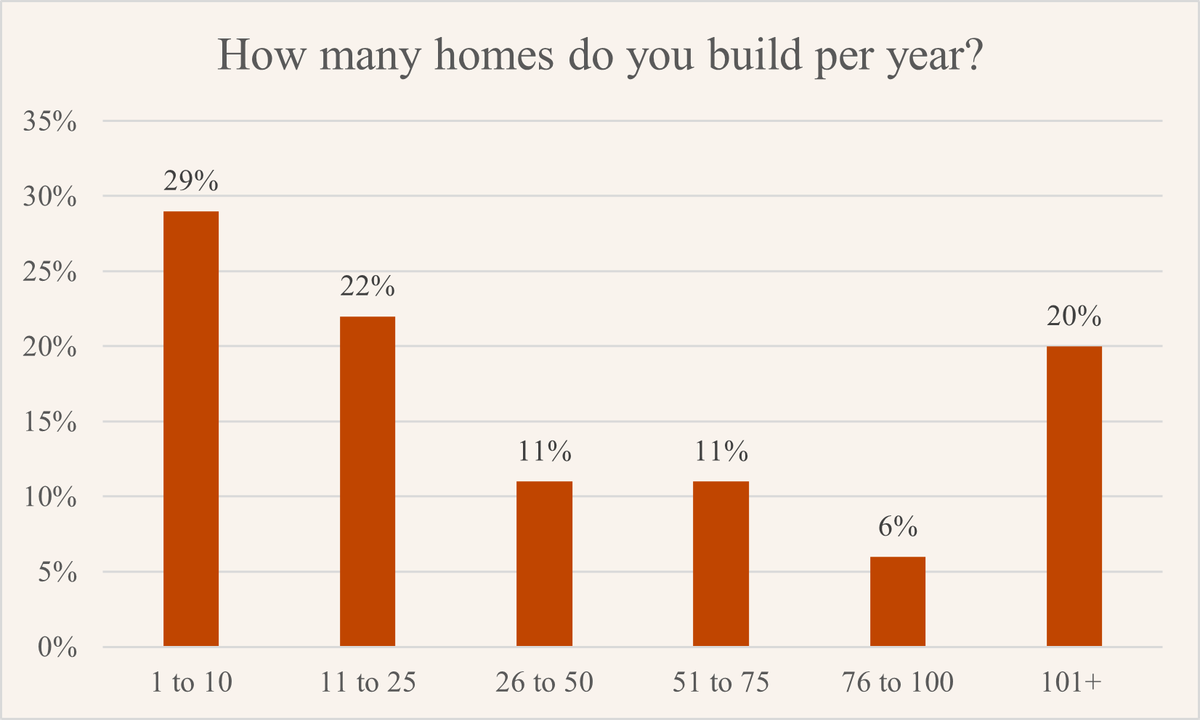

Size of company (by units built per annum)

The ‘SME’ category spans developers building anywhere from a handful of units to more than 100 each year. Our survey reflected this range, with 62% of respondents developing between 1 and 50 units annually.

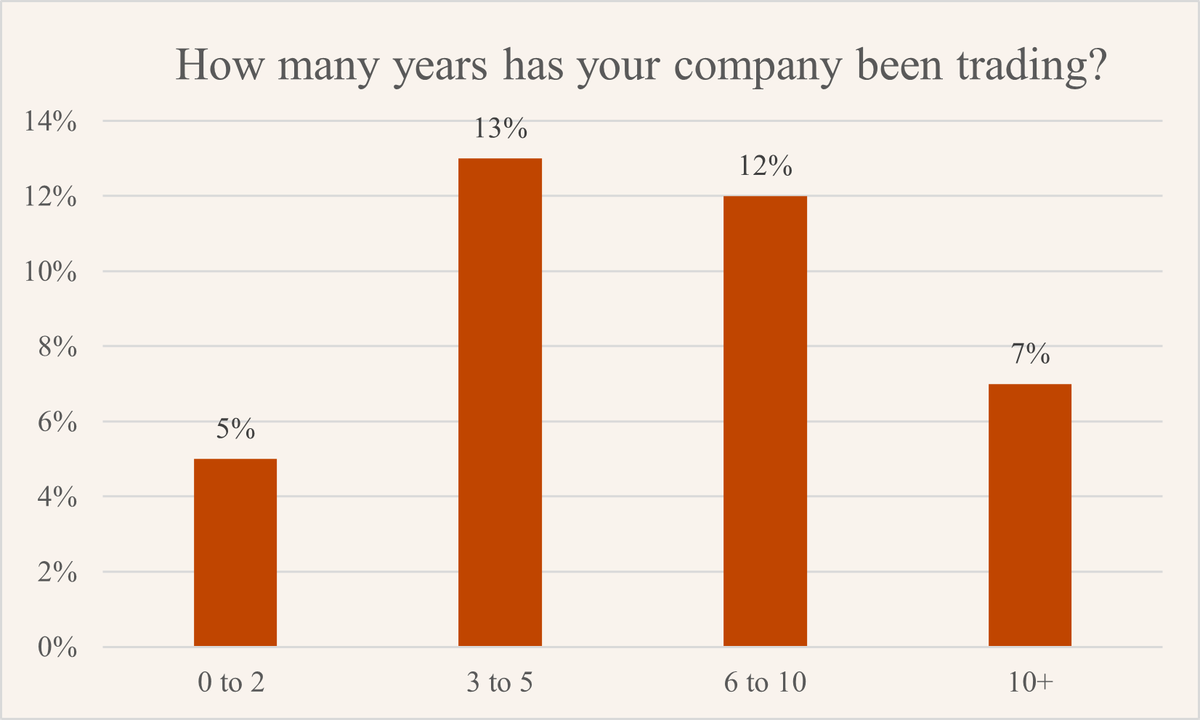

Length of trading

As demonstrated by the chart, 71% of respondents have been trading for more than 10 years, with 12% trading for between six to ten years. Therefore, respondents were typically very experienced in the industry, and many will have encountered multiple economic cycles.

Barriers to growth

While the Government has set an ambitious target of delivering 1.5 million new homes during the current Parliament, the likelihood of achieving this will depend on how effectively ministers address the critical barriers to delivery.

To prioritise these challenges, respondents assessed various obstacles to housing delivery, indicating whether each represents a major barrier, minor barrier, or no barrier to growth over the coming 12 months.

The top five major barriers to growth were:

- Delays in securing planning permission/discharging conditions – 94%

- Lack of resources in Local Planning Authority (LPA) planning departments – 89%

- Increasingly burdensome business taxation and regulatory environment – 67%

- Local and/or political opposition to new development – 66%

- Cumulative viability pressures – 64%

The remainder of this report examines these barriers in detail, explores their impact on housing delivery, and outlines potential ways to overcome them.

The planning process

The planning process has long been a significant barrier to growth for developers, particularly SME home builders.

Recognising these challenges, Sir Keir Starmer’s Government moved quickly following the Labour Party’s victory in the 2024 General Election to deliver on its pledge to reform the planning process and boost the supply of much-needed new homes, a step that was warmly welcomed by the industry.

The first step was the announcement that mandatory housing targets would be reinstated, overturning the policy introduced by the previous Conservative government under former Housing Secretary Michael Gove.

This was soon followed by the introduction of ‘grey belt’ into planning policy, the launch of the Planning and Infrastructure Bill and a series of working papers outlining proposed reforms to planning committees, nature recovery, brownfield passports, and other key areas.

In May 2025, the Government also announced an encouraging package of reforms aimed specifically at SME developers. The proposed list of measures included:

- Faster decisions for small sites: Minor developments of up to nine homes will benefit from streamlined planning and eased Biodiversity Net Gain (BNG) requirements, with faster decisions being taken by expert planning officers, not planning committees.

- A new ‘medium site’ category: Sites between ten to 49 homes will face simpler rules and fewer costs, including a proposed exemption from the Building Safety Levy and simplified BNG rules.

- More land and financing options for SMEs: Homes England will release more of its land exclusively to SMEs, and a new National Housing Delivery Fund will support long-term finance options, such as revolving credit facilities and lending alliances.

- A new pilot to unlock small sites for SMEs: the Small Sites Aggregator will bring together small brownfield sites that would otherwise not have been developed and attract private investment to build new social rent homes and address temporary accommodation challenges. It is set to be trialled this year.

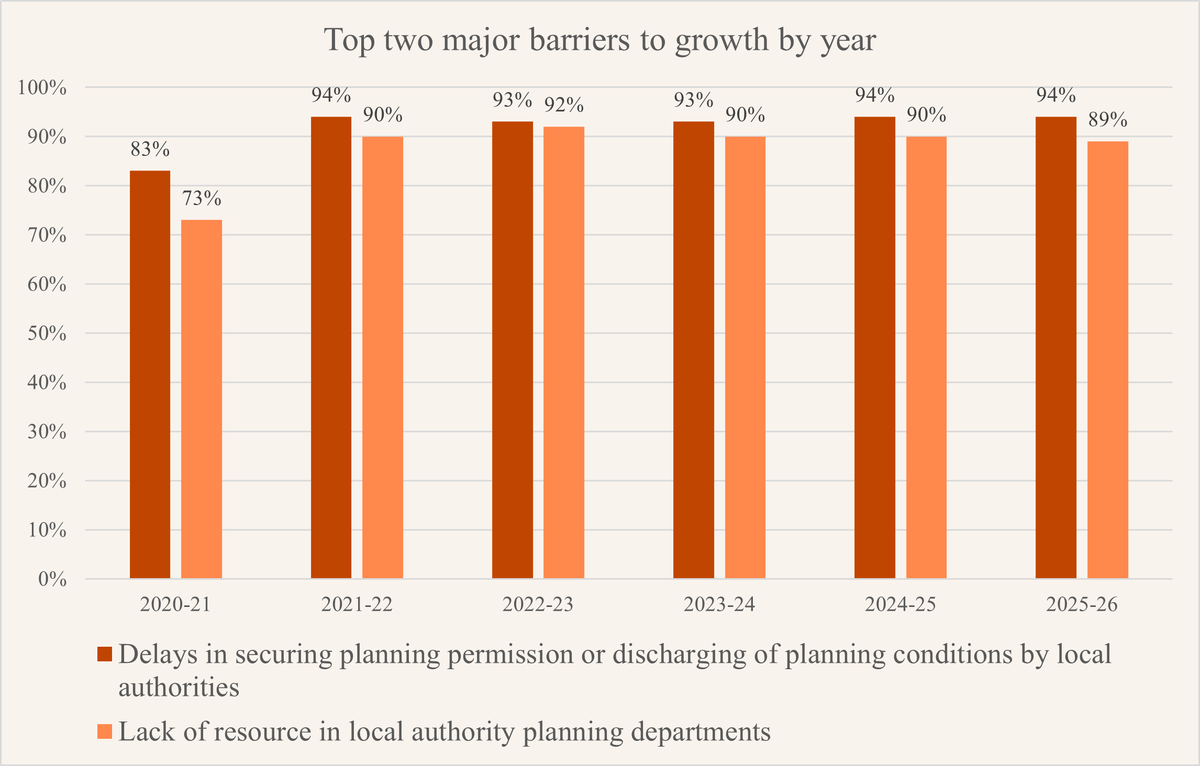

Despite the Government’s strong focus on planning reform, SME developers are yet to see meaningful improvements on the ground. As demonstrated by the following chart, 94% of respondents to our 2025–26 survey identified delays in securing planning permissions as a major barrier to growth, while 89% pointed to a lack of resources within local authority planning departments, continuing a trend that has persisted since 2021–22.

“I would go as far as to say the planning system is completely broken. There’s no accountability, reliability, positivity or even decent service. And don’t forget it is a PAID service, we are customers”

– Survey respondent

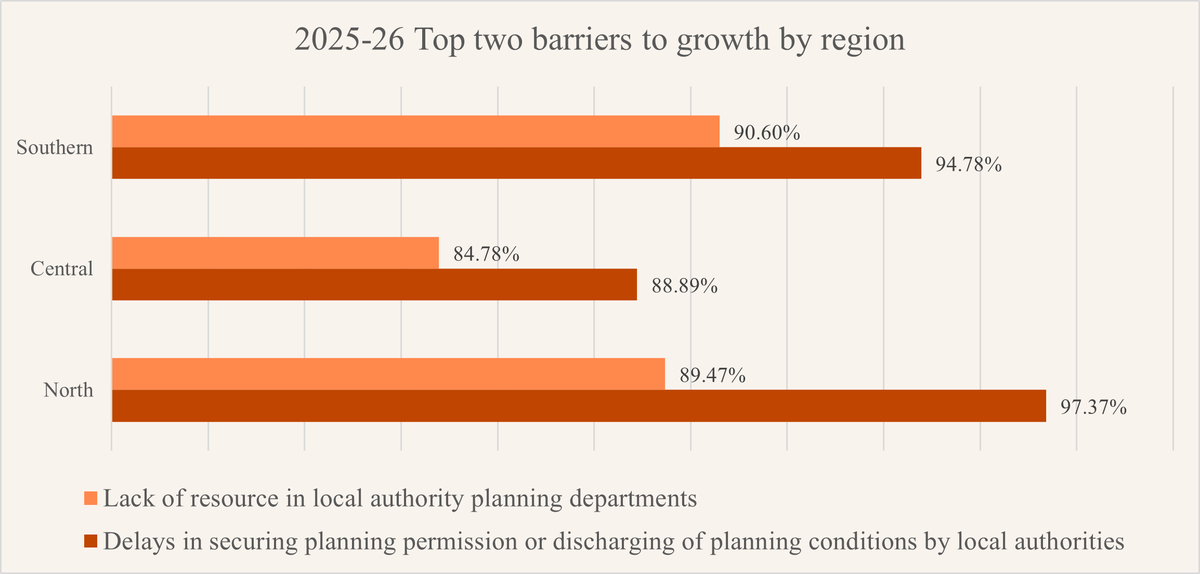

These were also the two leading barriers to growth across all regions, although respondents in the North were nearly ten percentage points more likely to cite planning delays as a major barrier compared with those in Central. The Government, to its credit, has committed to taking action to address these persistent challenges, including £46 million of additional funding to recruit and train 300 graduates and apprentices to work as junior planning officers.

While helpful, this is a drop in the ocean compared to the 2,200 additional planners that HBF research has identified is really needed across England and Wales to address current shortfalls.

Further change is expected through the Planning and Infrastructure Bill, which will give Local Planning Authorities (LPAs) the power to set their own fees, enabling full cost recovery and potentially delivering a more sustainable solution over time. However, the Government’s own Impact Assessment acknowledges that higher fees will increase costs for small, micro, and medium-sized businesses submitting planning applications, potentially placing additional pressure on SME developers.

As these businesses are more likely to submit minor applications (which are estimated to have the greatest funding shortfalls of between 50% and 150%), if LPAs set fees at the level of full cost recovery, MHCLG conceded “it is likely that the fees for minor applications will proportionately increase by a greater rate than fees for major applications, which may not increase by very much, if at all. This could potentially have a disproportionate impact on small, micro and medium-sized businesses.”

The extent to which SME developers can absorb these increases, and whether LPA performance improves as a result of a move to full cost recovery, remains to be seen.

"The planning system doesn’t support small sites, the affordable housing system doesn’t allow for small sites of entirely affordable, or realistic tenure mixes on smaller sites to be viable."

– Survey respondent

Planning process explored

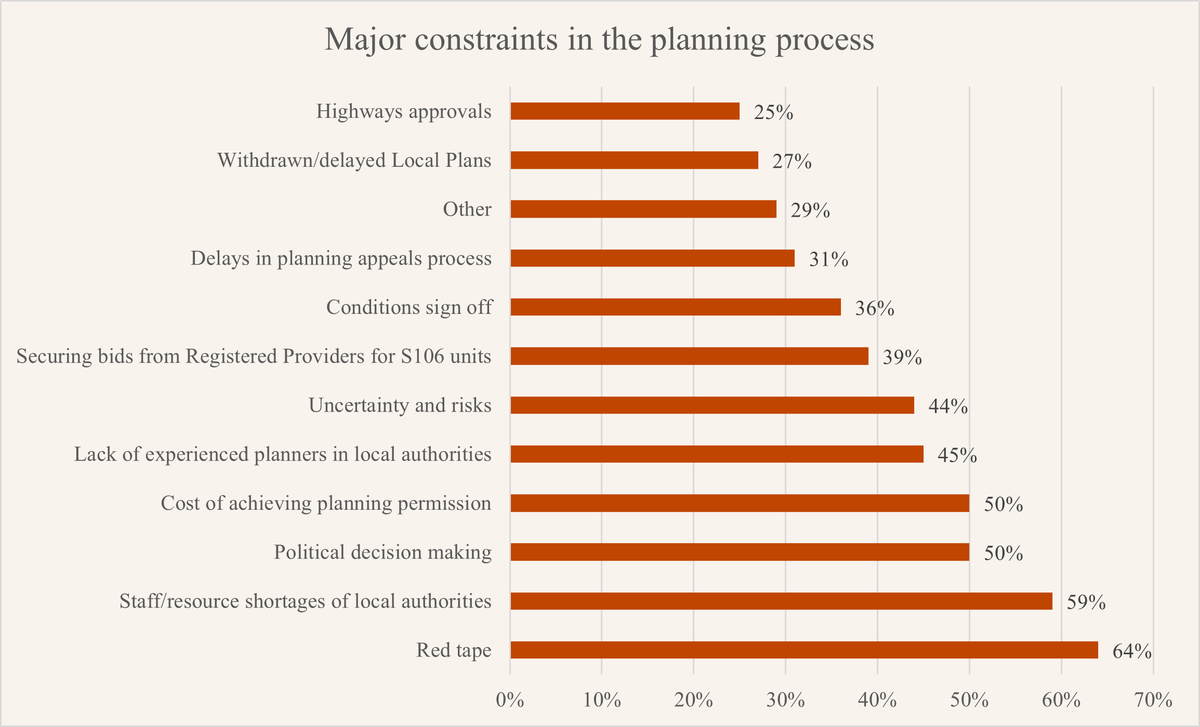

Alongside assessing overall barriers to growth, respondents were asked to rank the key constraints within the planning process. Red tape emerged as the most significant issue, cited by 64% of respondents, followed by resource shortages in Local Planning Authorities (59%), political decision-making (50%), and the cost of securing planning permission (50%).

When considering these results, it is important to note that the Government’s package of reforms to support SME developers was announced on 28 May, seven days after this year’s survey had opened.

However, other important policy developments for SME developers, such as increasing local planning authority (LPA) capacity and efficiency, reducing political influence in decision making through a national delegation scheme, improving statutory consultees’ performance, and incentivising the timely production of local plans, had been announced earlier.

Consequently, the main issue for SME developers is perhaps not a lack of Government action to improve the planning process, but that many of these policies, such as changes to site size thresholds, remain at the consultation stage and have yet to be implemented. Until they take effect, any benefits for SME developers remain hypothetical.

With the deadline for achieving the Government’s target of delivering 1.5 million new homes inching ever closer and the future of many SME home builders at stake, it is essential that these measures are implemented swiftly and effectively.

“The increasing burden of legislation and shortage of good sites with planning means that we will probably close our business in the next three years”

– Survey respondent

“It pretty much costs the same for a planning application of 5 units as it does for 500 units”

– Survey respondent

Section 106 Affordable Housing market

One area where the Government needs to take further action concerns the Section 106 Affordable Housing market, a persistent problem affecting builders of all sizes, but especially acute for SME developers.

Over the past few years, many home builders have struggled to secure bids from Registered Providers (RPs) for their Section 106 Affordable Homes, largely due to the financial headwinds facing this part of the housing sector. Indeed, 65% of respondents to this survey said that the issue presented a barrier in the planning process and 58% reported that it was a major barrier to growth.

Earlier this year, HBF conducted a Freedom of Information (FOI) request with Local Authorities to determine the potential scale of the issue. Analysis of responses from more than 85 Local Authorities, extrapolated to all 317 Local Authorities in England and Wales, indicates:

- Approximately 900 completed Section 106 Affordable Housing units remain unsold due to the absence of contracts with RPs.

- Around 8,500 S106 units, either under construction or due to commence within 12 months, are not currently under contract with an RP.

- More than 700 sites have been delayed or stalled over the past three years because developers could not secure an RP to acquire the affordable units.

These findings highlight ongoing constraints on delivering both Section 106 Affordable Homes and market-sale units which not only threaten housing supply, but the future of SME developers.

As many smaller home builders have found, RPs typically show limited interest in acquiring small numbers of Section 106 homes (e.g., fewer than 30). This leaves smaller sites, and the developers building them, at risk.

As a result, some developers are deliberately targeting smaller sites than they otherwise would, to avoid Affordable Housing requirements and the associated risk of failing to secure an RP. Inevitably, this has an impact on the growth aspirations of the SME developer and on the delivery of both private market housing and Affordable Housing.

In the worst cases, some SME home builders are unable to commence on-site work at all. As many SME developers rely on project-based financing to maintain cash flow and begin construction, without a contract to sell the Section 106 homes to an RP or local authority, accessing this financing is often impossible. For some SME developers, this barrier may prove insurmountable, threatening the viability of their businesses.

It was certainly positive that the recent Spending Review included measures aimed at stabilising the RP sector, including: £39 billion in additional funding over the next decade, a long-term rent settlement of RPI +1%, access to the Building Safety Fund and the reintroduction of rent convergence. Combined, these measures are expected to strengthen RP capacity and investment confidence in the medium to long term.

However, an urgent short-term solution remains necessary. When asked what action the Government should take to help tackle the problem of the shortage of bids from Registered Providers for Section 106:

- 55% said sites with fewer than 50 units should be exempt from Affordable Housing requirements.

- 15% said grant funding under the Affordable Homes Programme should be used on Section 106 Affordable Homes.

- 14% suggested using a Written Ministerial Statement (WMS) encouraging Local Authorities to take a more flexible approach to the use of cascade mechanisms and, as a last resort, commuted sums, in Section 106 Agreements.

“Despite the constant reminding to councils of the simple facts that Registered Social Landlords (RSLs) are not buying and proving that schemes are unviable, they continue to ignore the facts presented to them and carry on regardless and then they wonder why schemes are not coming forward”

– Survey respondent

“SME house building has been seriously affected by S106 crisis and if not resolved will mean the majority will pack up or go bust”

– Survey respondent

Viability

Overall viability pressures and business environment

While the top two major barriers to delivery remain the same as last year, SME developers now say the third biggest barrier to delivery is the increasingly burdensome business taxation and regulatory environment:

- 67% of respondents believe the overall business environment is a major barrier to delivery.

- A further 30% say business taxation and the regulatory environment are a minor barrier to the growth of their business in the next 12 months. Similarly, cumulative viability pressures are now one of the main barriers to delivery for SME home builders. For a site to be viable, the value generated by the development must be more than the total costs of developing it.

These costs include those relating to construction, regulation, taxes, marketing, affordable housing contributions, finance interest, as well as a necessary return on investment.

However, 64% of respondents now agree that viability is a major barrier to growing their business in the next 12 months. This is unsurprising, given that a range of new policy costs, taxes and regulations placed on the industry have stretched viability to breaking point on many sites. These new costs also often disproportionately affect SMEs.

A summary of the new policy costs and taxes forthcoming or introduced in recent years are outlined in the table below:

| 2019 | 2025 | Comments | |

|---|---|---|---|

| Policy costs / timescales | |||

| Building Safety Levy (BSL) | None | £3k per plot on average | New BSL squeezes viabilities |

| Future Homes Standard | No | Imminent | Additional cost for builders and homeowners of around £8-10k per plot depending on a developer’s chosen approach and site and location constraints. |

| Electrical Vehicle Charging | No | £500-£1,500 per plot for 7KW domestic chargers | Introduced in 2022 |

| Biodiversity Net Gain | No | Yes, significant costs | Additional costs and often intensive land use |

| Corporation Tax (general) | 19% | 25% | General increase in Corporation Tax at Spring Budget 2021 |

| Corporation Tax (UK residential developers) | 0% | 4% | Since 2022, UK home builders paying additional four percentage points on Corporation Tax through the Residential Property Developer Tax |

| Building Safety Regulator | No | Significant time and cost | Introduced in 2024 |

| Landfill Tax on inert material | £4.05 per tonne | Consulted on increase to £126.50 per tonne, equivalent to £15,000 per plot on average. | Awaiting government response to its consultation \ One developer has estimated their annual Landfill Tax bill will rise from around £3m per year to more than £110m. For small and medium-sized home builders, the impact is likely to be particularly acute. As government raises Landfill Tax so significantly, some builders with scale may be able to recycle materials such as topsoil from one site to another. For SMEs operating on fewer sites, and perhaps only a single site, this is not possible. |

Many of these new costs were introduced without due notice to house builders, and in relation to which specific details have remained unknown until very late in the implementation process. As a result, ongoing projects are being put at risk, with SME home builders bringing forward fewer new projects due to the increased uncertainty and cost.

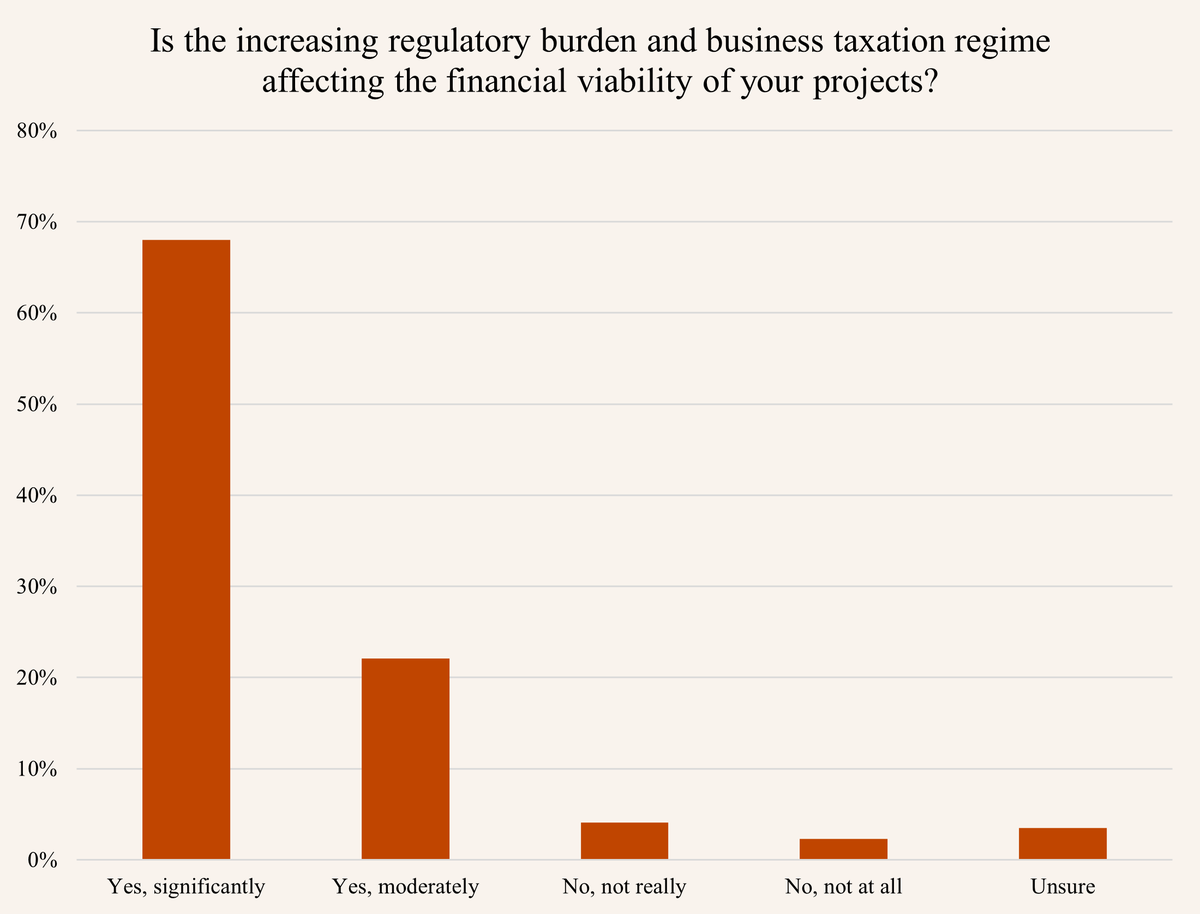

When asked whether the increasing regulatory burden and business taxation regime is affecting the financial viability of projects:

- 9 out of 10 respondents said it was impacting their business.

- 68% said it was significantly impacting their business.

- Just 6% said that it wasn’t impacting their business.

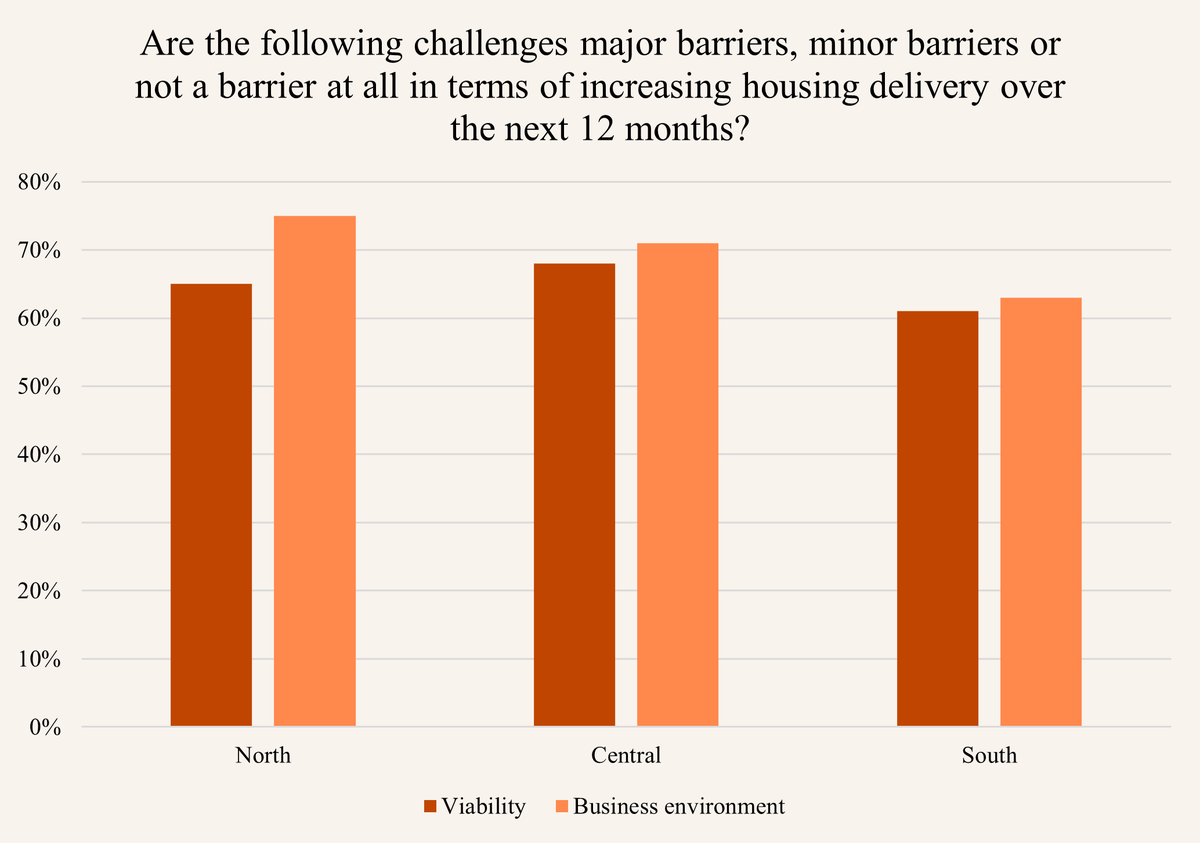

Furthermore, this year’s survey results show that viability pressures are not confined to a particular region of the country, suggesting that the cumulative burden of policy costs is dampening development activity in all parts of England, not just those where land costs are highest.

“The regulatory burden continues to increase. It must be made simpler for SMEs to survive”

– Survey respondent

“It is fundamentally harder than it has ever been to operate profitably”

– Survey respondent

“Desk top back-room viability studies carried out by councils are so far off the mark compared to actual detailed costings carried out by our own QS making the schemes look much more viable than they are”

– Survey respondent

Building Safety Levy

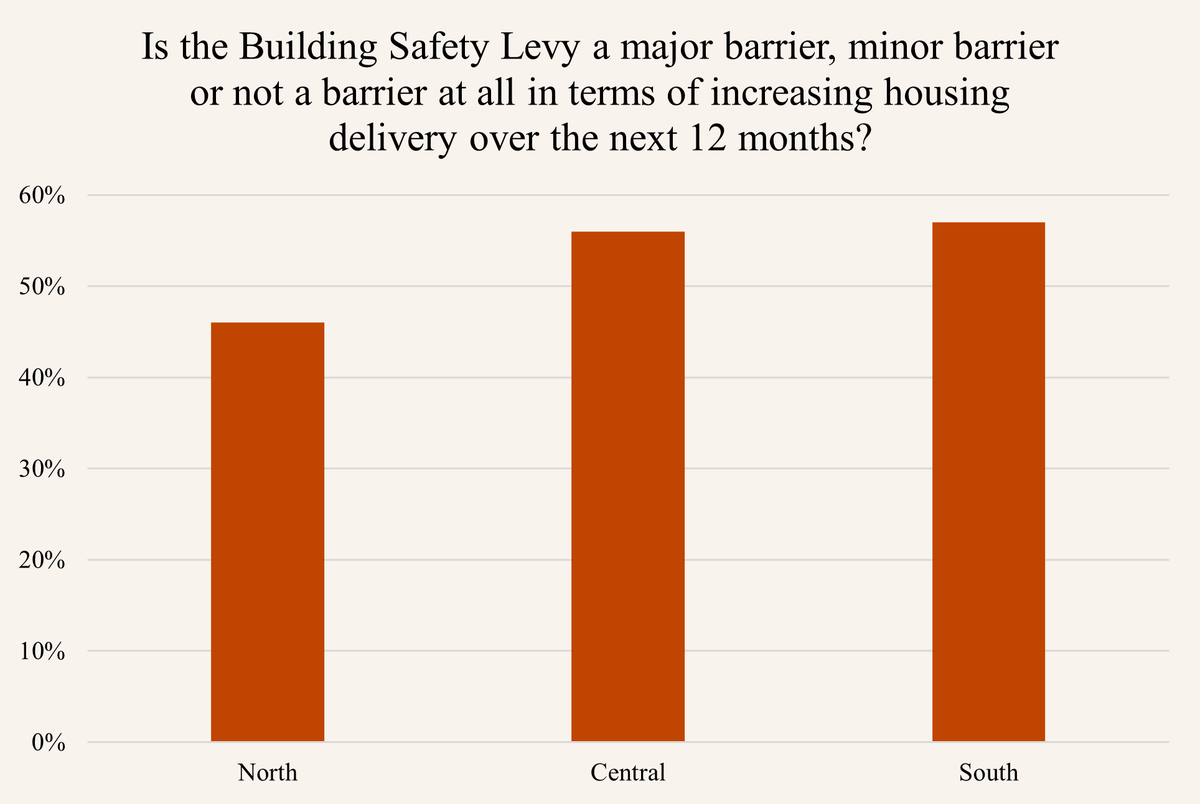

One particularly concerning forthcoming tax on developers is the Building Safety Levy. Overall, 54% of SME home builders say the new Levy and resultant costs will be a major barrier to increasing delivery in the next 12 months.

By way of background, the Building Safety Levy is intended to raise £3.4 billion from UK home builders for remediation efforts. The home building industry has a longstanding and ongoing commitment to the principle that leaseholders should not be expected to pay for cladding remediation that has been necessitated by either inadequate building regulations or construction defects.

However, the industry has already committed £6.4bn to building safety remediation efforts – with no contributions made by product manufacturers or overseas developers. The Levy will have a particularly disproportionate impact on SME home builders because it will add thousands of pounds to the cost of providing each new home – a cost that many SMEs will be unable to absorb.

It is particularly unfair that many SME home builders who have never built higher than two-storey family homes will be forced to pay these additional costs for remediation of high-rise buildings. While the Government is exploring exempting developments of 49 homes or fewer from the Levy, many SMEs build sites of 50 homes or more and the Government has not yet confirmed it will proceed with this proposal.

Another concern is that home builders will be expected to pay the full levy liability at the point of the first home completing, meaning that builders will be forced to pay what will amount to hundreds of thousands of pounds in additional taxes at the point of peak capital outflow on each site.

This will especially burden SME home builders who may not have the available cashflow to pay the Levy until development is completed. It also seems likely that the Levy was devised and designed by the previous Government to reduce housing supply, particularly in parts of the country with the greatest housing affordability pressures. Therefore, it is unsurprising that SME home builders in the South are particularly concerned about the Building Safety Levy, with 57% saying the Levy will be a major barrier to delivery, compared to 46% in the North.

Given the likely disproportionate impact on SME home builders, the Government should suspend its plans to introduce the Levy or, at a minimum, proceed with its proposals to exempt small and medium sites.

Biodiversity Net Gain (BNG)

Biodiversity Net Gain (BNG) is an approach to development that ensures that habitats for wildlife are in a better state at the development’s completion than before projects began. Under this framework, developers must achieve a minimum 10% net gain in biodiversity, as measured in biodiversity ‘units’.

Since the last time this survey was conducted, the reality of BNG implementation on the ground has become clearer, with the policy introduced for small sites in April 2024. 55% of SME home builders consider BNG implementation to be a major barrier to delivery, up from 47% last year, suggesting that the reality of BNG on the ground over the past year has been more challenging than expected.

While SME developers remain committed to ensuring that new homes and environmental benefits go hand in hand, BNG’s implementation in practice has had a disproportionate impact on SMEs for several reasons:

- On-site BNG is not always possible for smaller sites because there is not enough available land. This means SMEs have a greater reliance compared to larger developers on delivering BNG through expensive off-site units, the costs of which can undermine the viability of projects.

- In many cases appropriate off-site units are not available at all. This is because small sites often require only fractions of a biodiversity unit to meet BNG requirements, but the market has not yet developed sufficiently to meet this demand, leaving SMEs with fewer options.

- Smaller developers lack the staff and resources of larger firms. As a result, navigating BNG guidance and completing additional plans and assessments presents a significant administrative and financial burden, further stretching viability.

It is worth noting that this survey was conducted before the outcome of Defra’s consultation on BNG, which proposed exempting sites of 9 or fewer units and allowing sites of 10-49 units to use the Small Sites Metric. It is unclear when or if these proposals will be implemented. In the meantime, the implementation of BNG will clearly continue to be challenging for SME home builders.

“I fear as an industry we do not speak out enough about the issues coming down the pipe (e.g. Building Safety Levy)”

– Survey respondent

“The regulatory burden continues to increase. It must be made simpler for SMEs to survive”

– Survey respondent

"BNG has exacerbated delays…More council ecologists would improve the speed of delivery”

– Survey respondent

“BNG on sites under 10 needs to be paused immediately and reviewed with a hopefully removal of these sites”

– Survey respondent

Cost of essentials: Land, labour and materials

The accumulation of additional national policy costs and taxes from central government comes as the costs of various essential outlays – land, labour and materials – continue be a hindrance.

Skills

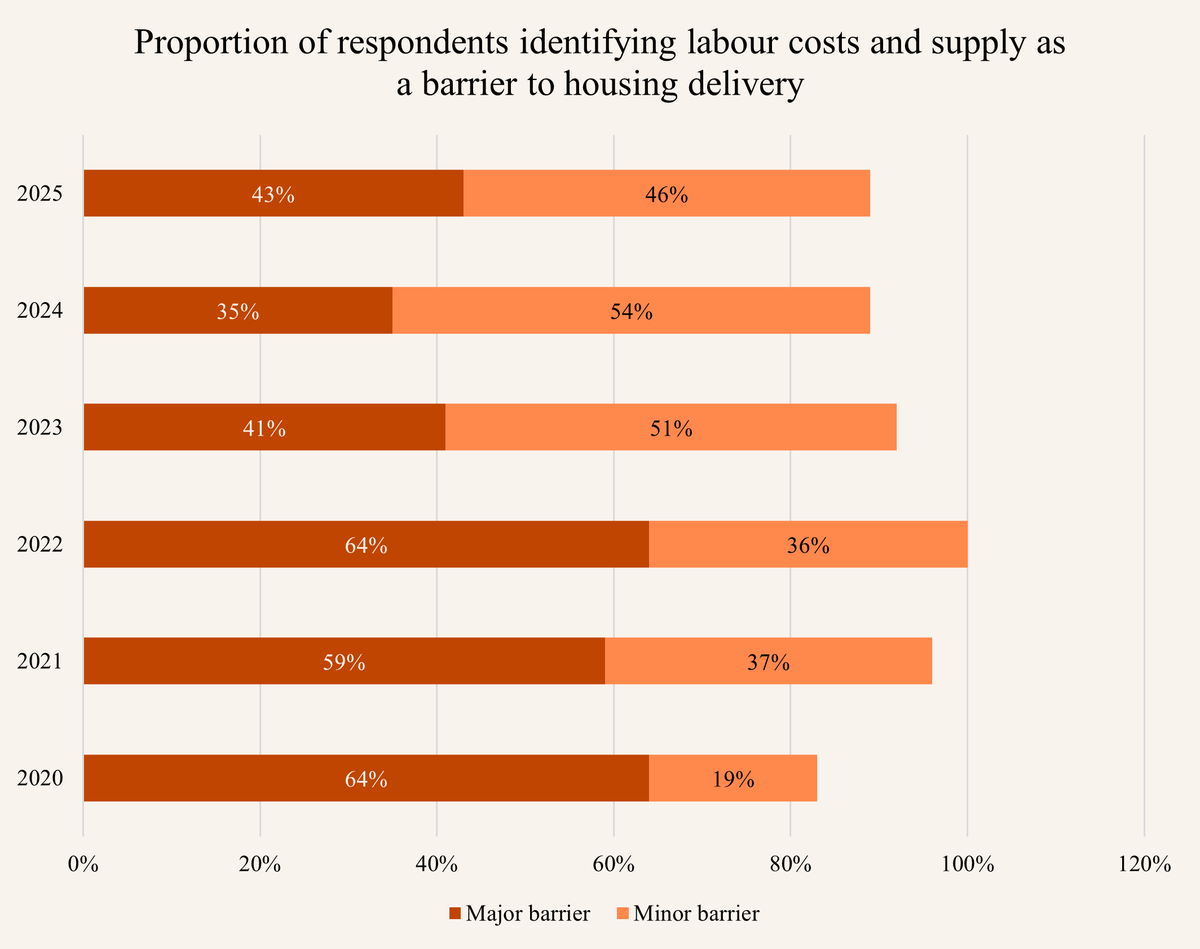

One major issue is the skills shortage and resultant labour costs, which has continued to be a barrier to the building of homes, particularly for SME builders, in recent years. This year’s survey shows that 88% of respondents believe the supply and cost of labour is a major or minor barrier to growth. While this is consistent with previous years, the proportion of respondents saying skills costs and availability are a major barrier has risen from 35% to 43% in the past year, suggesting the skills challenge is intensifying.

The skills gap is an issue that has been many years in the making. Around 25% of the existing home building workforce is over 50, meaning the sector is facing an impending retirement cliff edge. At the same time, not enough new recruits are entering roles through the education sector to replace them. Furthermore, there has often been a lack of government understanding of critical future skills needs, including green skills.

For SMEs, the problem is particularly challenging, because organisations have to become a “licensed sponsor”, a process which is expensive, time-consuming and bureaucratic. With so much of the subcontractor workforce made up of small and medium-sized businesses, this presents a huge administrative burden for SMEs in particular.

Looking to the years ahead, if demand picks up and the Government’s planning reforms begin to have a positive effect on housing supply, the skills shortage would resurface as a major barrier. Research undertaken by HBF has found that for every 10,000 new homes the industry builds, 30,000 new recruits

are needed, including but not limited to 2,500 bricklayers, 2,500 groundwork/plant operatives and 1,000 carpenters.

The industry is responding to these challenges, publishing a Sector Skills Plan earlier this year to provide a clear roadmap for tackling the industry’s longstanding workforce challenges. With the Government also pledging £600 million of investment to train tens of thousands of new construction workers, there can be greater optimism that progress will be made to address this skills gap in the years ahead.

"The current Government have hit our business hard with National Insurance increases that have cost us £60kpa and stopped us from employing more people”

– Survey respondent

“There is also a significant skill shortage with consultants (architects and engineers)”

– Survey respondent

Land and materials

Alongside labour costs, another essential outlay is the buying of land for development. 54% of SME developers say the price of land is a major barrier to increasing delivery, similar to last year. The price of land remains high because demand for small sites continues to outstrip supply, with many local plans not allocating a sufficient number of viable smaller sites. Furthermore, high initial land costs, when combined with the accumulation of national policy cost and taxes in recent years, simply render many potential sites unviable.

More positively, however, only 10% of SME developers said the supply chain and materials availability were a major barrier to growth, and just 30% of respondents said the cost of materials was a major barrier to delivery this year. While material costs are still putting pressure on business costs, this is down from 33% of respondents last year and well down from 42% in 2023. Therefore, it appears that pressures caused by high material costs are slowly easing following the inflation spike of recent years

“More land needs to come to market, but any planning changes will take a number of years to be pushed through to approvals and land sales”

– Survey respondent

“Build costs as a proportion of Gross Development Value are higher than I can remember”

– Survey respondent

Market

The housing market has faced sustained turbulence over the last several years, shaped by a complex mix of economic pressures, shifting policy support, and structural challenges.

On the demand side, households have been hit by the steep rise in interest rates since late 2021, a policy response to inflation that has pushed up the cost of borrowing. For many would-be buyers, particularly first-time buyers, this has translated into higher mortgage repayments and stricter affordability criteria, making entry to the market increasingly difficult.

The withdrawal of the Help to Buy Equity Loan scheme has compounded these issues by removing what was, for a decade, a cornerstone of government support for new buyers. Together, these factors have weighed heavily on consumer confidence, leaving many aspiring homeowners feeling locked out.

First-time buyers

The supply side of the market is equally constrained by this. Sluggish demand feeds directly into reduced delivery, as developers are hesitant to bring forward new projects in an environment where homes are slower to sell. This effect is most visible among SME developers, who play a crucial role in housing delivery but are disproportionately exposed to risk. Unlike larger national house builders, smaller firms often lack the financial reserves to absorb long sales periods or to take on speculative development without certainty.

Survey data reflects these dynamics. A majority of respondents identified slower sales rates as a barrier to development. 58% flagged the lack of dedicated support for first-time buyers as a major obstacle, with a further 26% citing it as at least a minor one.

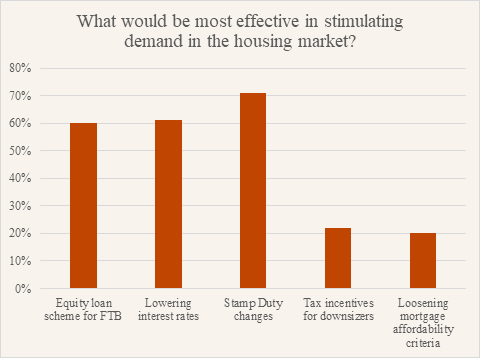

When asked what interventions would have the greatest impact, respondents pointed to a consistent set of policy levers: adjustments to Stamp Duty, reductions in interest rates, and the reintroduction of an equity loan scheme targeted at first-time buyers. Together, these measures would not only stimulate demand but also restore the confidence needed for developers, particularly SMEs, to increase delivery.

"Lots is being done on the supply side but this isn’t having the delivery impact expected. The Government need to assist with the demand side to really drive production”

– Survey respondent

“The sales market for London and the south east is very stagnant at present. We’ve interest rates heading south, although a lot slower than anticipated”

– Survey respondent

“Without the introduction of a Government backed stimulus for first time buyers the housing market will remain in first gear”

– Survey respondent

Development finance

For SMEs to continue growing and delivering the housing the country needs, it is essential that they have access to development finance, and that lenders and investors are adequately incentivised to operate in this sector.

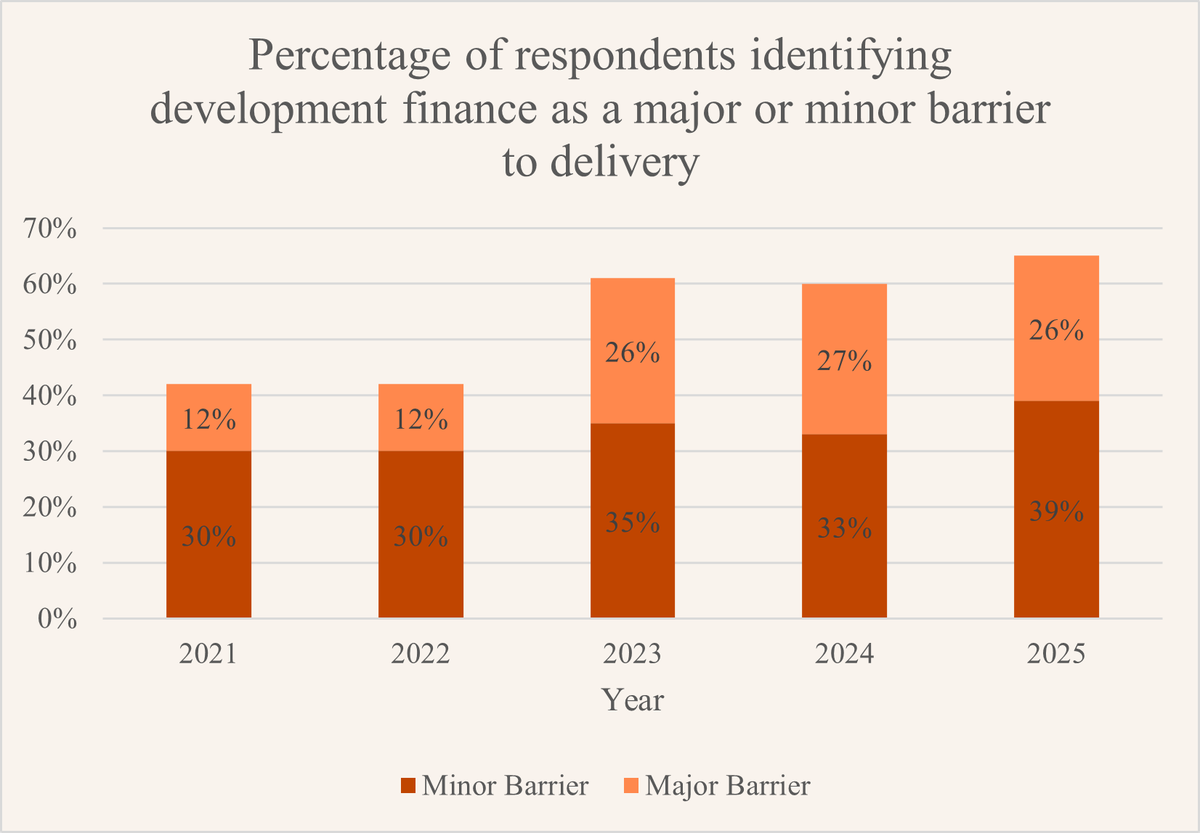

In today’s challenging economic environment, both the availability of finance and the terms on which it is offered are particularly important for SME developers. Therefore, it was encouraging that 35% of respondents reported that development finance is not a barrier at all. However, this represents a five-percentage-point decrease compared with last year.

Meanwhile, the proportion of respondents considering it a major barrier has grown from 33% in 2024 to 39% in 2025, reflecting the combined impact of ongoing planning and Section 106 Affordable Housing uncertainties, and the resulting challenges developers face in accessing finance.

As such, while access to development finance may not be as problematic as some of the other issues highlighted in this report, the survey results indicate that there is still work to be done.

"The pressures of high development finance costs combined with slower sales rates is having a huge impact on the viability of developments”

– Survey respondent

Infrastructure

The delivery of new homes is increasingly constrained by the provision and adoption of critical infrastructure. Housing schemes cannot proceed without timely connections to utilities such as water, wastewater, electricity, and without the adoption of essential amenities like roads, lighting, and open spaces.

Yet in practice, developers are facing inconsistent processes, escalating costs, and lengthy delays across all of these areas. These infrastructure challenges are not only slowing the pace of delivery but also creating significant financial risk, particularly for SME builders who lack the resources to absorb prolonged uncertainty.

Provision and adoption of utilities and infrastructure

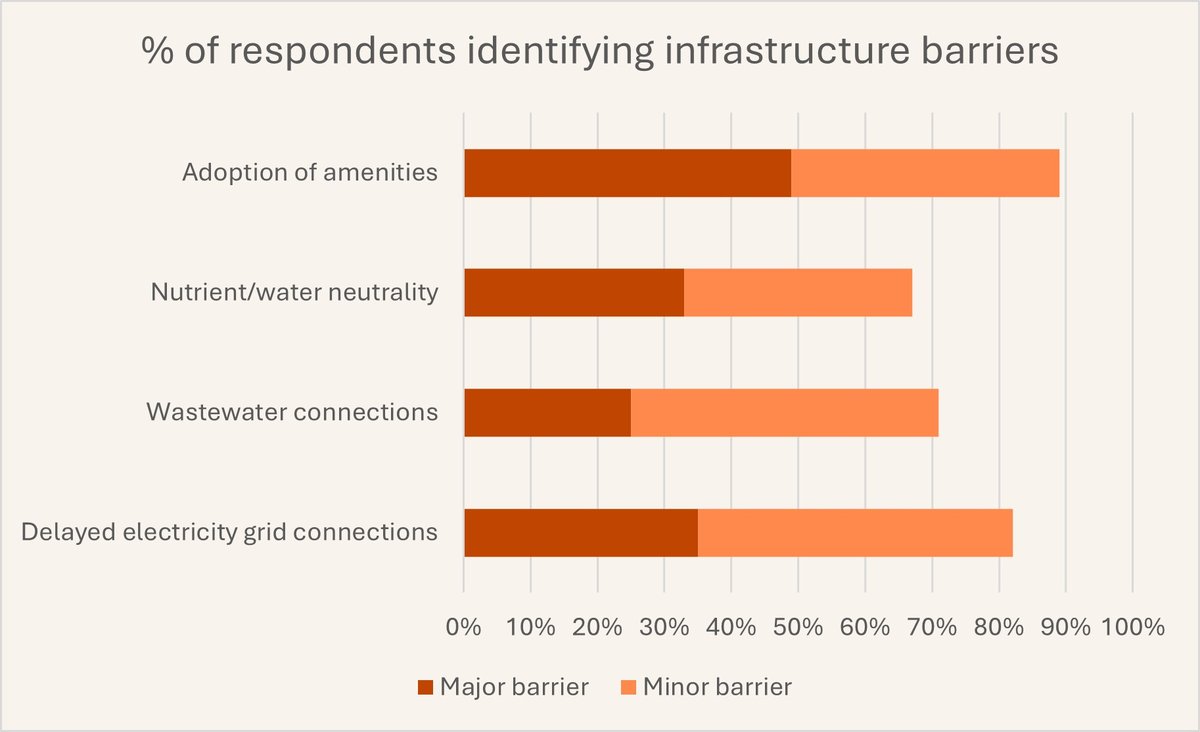

As in previous years, issues relating to the provision and adoption of utilities and infrastructure have continued to be a significant barrier to delivery:

- 89% of respondents identified this as either a major or minor barrier to delivery, with half of respondents citing it as a major barrier.

- This figure was consistent across all regions, with 50% of Northern, 48% of Southern and 54% of Central respondents agreeing this was a major barrier.

Issues relating to unadopted amenities (for example roads, pavements, and street lighting) on new housing estates are a growing concern, particularly the costs and timescales associated with adoption. Traditionally, the management, maintenance and upkeep of infrastructure such as roads, drains, street lighting and open spaces have been the responsibility of local authorities, often built by developers as part of new housing schemes but funded in the long run through council tax.

However, the Competition and Markets Authority’s (CMA) house building market study confirmed that there has been a decrease in levels of adoption of roads and amenities on new estates by relevant authorities in recent years. This leads to unfair costs for residents, who are charged the same amount of council tax in addition to fees for privately maintaining adopted roads and amenities.

The adoption of highways is particularly problematic for the industry. For instance, local authorities are often reluctant to adopt highways under Section 278 and Section 38 agreements unless excessive fee demands are paid, with the average cost per ‘highway bond’ reaching up to £3,606,408 in 2022/23.

Furthermore, there is significant geographical variation in the timescales involved in negotiating such agreements - with the time between technical submission and formal adoption of highways under Section 38 agreements ranging from 4 weeks up to 286 weeks in particular 2022/23.

In practical terms, these inconsistencies and costs in adopting amenities lead to more delays in the planning process and are further dampening housing supply. Unsurprisingly, the timing and budgetary inconsistencies are also a particular hindrance on the output and productivity of SME house builders.

The CMA recommended that the Government introduces common adoptable standards and mandatory adoptions for public amenities. It is critical that the Government takes forward these recommendations in a timely manner.

Nutrient / water neutrality

Alongside adoption, developers highlighted a series of other critical infrastructure-related barriers that continue to slow or even prevent housing delivery. A prominent challenge is nutrient and water neutrality:

- 33% of respondents identified this as a major barrier

- a further 34% identified it as a minor barrier.

The issues associated with nutrient neutrality in particular is something that has acted as a block on development in large swathes of the country since 2019.

While the industry is committed to protecting our waterways, currently businesses are being disproportionately impacted by the measures.

Recent government interventions – such as funding for nutrient mitigation schemes – have been welcomed but progress remains slow.

Local planning authorities often lack the resources or mechanisms to deliver mitigation at scale, leaving developers facing lengthy delays and significant uncertainty about when and how permissions can be secured. The approach also continues to be fragmented, with multiple agencies required at various stages of the process, and varying approaches across different geographical regions.

"More council ecologists would improve speed of delivery of planning permissions due to lengthy BNG and phosphate report approvals. BNG has exacerbated the delays, with phosphate mitigation approval now taking six months for reports to even be read, let alone approved”

– Survey respondent

"In housing we are paying to sort out issues not of our making (such as water/phosphate neutrality”

– Survey respondent

Wastewater connections

Wastewater connections present another area of persistent difficulty. 71% of respondents reported this as either a major or minor barrier. HBF’s survey of members over this issue found that almost 30,000 new homes are currently blocked, including 7,000 Affordable Homes

This is closely tied to the performance and regulatory oversight of water companies, who are under increasing scrutiny for failing to invest sufficiently

in network upgrades and environmental protection. Ofwat has made an effort to take an active role in shaping and standardising the charging regime for water companies’ infrastructure fees, but the 2024 Price Review has exacerbated the situation for home builders, with changes to the way infrastructure charges are calculated. HBF’s research found that sewerage companies in England and Wales have collected almost £2.3 billion from developers since 2020 to support infrastructure enhancements.

National planning policy dictates that responsibility for wastewater infrastructure lies with water and sewerage undertakers, not individual planning applicants. Additionally, the National Planning Policy Framework (NPPF) makes clear that local planning authorities (LPAs) should assume infrastructure providers will meet their legal duties. However, a growing number of councils are refusing to grant permission or discharge planning conditions due to perceived uncertainty over sewerage provision.

This disconnect is creating serious delays across the housing sector, particularly for smaller developers with vital associated community investment also being held back. The 30,000 stalled homes would generate an estimated £900 million in Section 106 contributions, funding schools, roads, green spaces, and public amenities.

Home builders are urging ministers to reaffirm existing planning policy, remind councils of water companies’ statutory responsibilities, and ensure housing targets are properly reflected in long-term water resource management and wastewater infrastructure plans.

Delayed grid connections

Electricity grid capacity was also highlighted as a significant constraint, with 35% of respondents identifying delayed grid connections as a major barrier and 47% as a minor barrier. This issue has become more pronounced in recent years as demand for grid capacity has risen sharply, not only from new housing but also from renewable energy projects, electric vehicle infrastructure, and wider decarbonisation initiatives. In many parts of the country, developers face multi-year waits for grid connections, pushing back housing delivery timelines and creating uncertainty for investment decisions. National Grid and Ofgem have acknowledged these challenges and have begun reforms to the connection process, but there remains a considerable backlog that directly impacts housing supply.

Taken together, these issues underline the extent to which the delivery of new homes is dependent on wider policy and regulatory frameworks for utilities and infrastructure. Without clearer responsibilities, faster decision-making, and greater investment in capacity, developers will continue to face barriers outside their control, delaying much-needed housing delivery and undermining national targets.

Business outlook

Given the numerous challenges facing SME developers, it is unsurprising that there is widespread scepticism about the Government’s target of delivering 1.5 million new homes.

Indeed, an overwhelming 97% of respondents believe this target is either very or somewhat unachievable, with 88% describing it as very unachievable. Only 2% considered the target to be somewhat achievable.

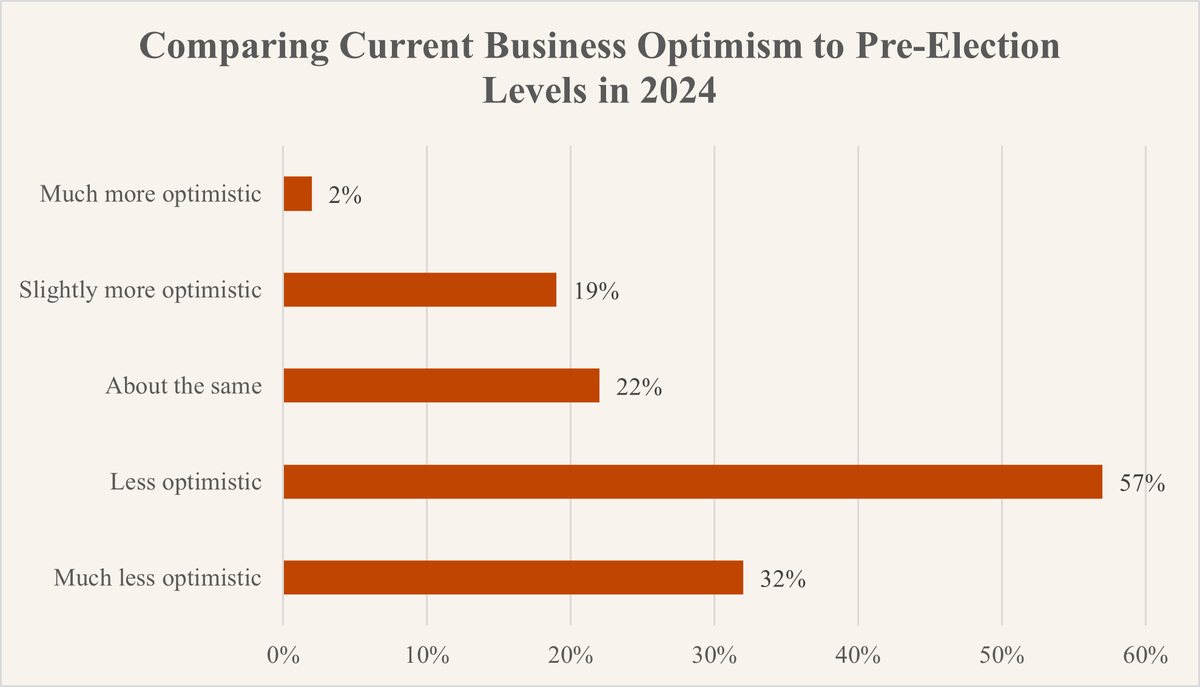

This pessimism extends beyond national housing targets to developers’ views on their own business prospects. When asked to compare their current level of optimism with how they felt in the run-up to last year’s General Election, over half (57%) reported feeling less optimistic, with nearly a third (32%) saying they were much less optimistic.

Meanwhile, 22% said their outlook remained about the same, 19% felt slightly more optimistic, and just 2% reported being much more optimistic.

“The government doesn't know what's happening at grass roots level - all talk and no action”

– Survey respondent

“There’s lots of positive talk, but the reality is policy may deliver in the next Parliament. We need urgent action”

– Survey respondent

“The increasing burden of legislation and shortage of good sites with planning means that we will probably close our business in the next three years”

– Survey respondent

However, hope remains for the Government. By addressing the challenges highlighted in this report and implementing the recommended actions, SME developers could significantly increase the number of units they build annually.

For six years now, this report has tracked the many barriers hampering SME home builders. This year, many new barriers have emerged, such as additional business taxation including the forthcoming Building Safety Levy and proposed changes to Landfill Tax.

The challenges outlined in this report threaten to accelerate the decline of SMEs in the home building industry in the years ahead. While the new Government has introduced many welcome reforms to planning to support SMEs, it must now go further and faster to support this vital part of the industry. The Government cannot achieve its housing ambitions and foster the diverse housing market it wants to see unless it enables SME home builders to deliver.

Recommendations

Respondents were asked to identify the top three actions that Government could take to deliver the greatest positive impact on SME house builders. The findings reveal clear priorities, with a strong emphasis on reducing barriers to entry and improving the operating environment for smaller developers.

Most frequently selected actions:

- Simplify and reduce the cost of the planning process – This was by far the most popular recommendation, cited by 52% of respondents. SMEs consistently highlighted the complexity, time delays, and high costs of the current planning system as one of the biggest obstacles to growth and delivery.

- Increase the availability of small sites through Local Plans – Identified by 31% of respondents, who noted that SMEs are disproportionately reliant on access to smaller parcels of land, which are often overlooked in current planning allocations.

- Reduce CIL and Section 106 obligations – Supported by 30% of respondents, reflecting concerns that these requirements place a heavier burden on SMEs relative to larger developers, undermining site viability.

- Stimulate demand, for example through a new equity loan scheme for first-time buyers – Proposed by 29% of respondents, to help support and market confidence and investment, particularly in a challenging economic climate.

- Address challenges within the Section 106 Affordable Housing market – Also backed by 19%, with SMEs reporting that a lack of viable bids from Registered Providers is creating barriers to site delivery.

- Reduce the overall regulatory burden – Highlighted by 19%, with calls for proportionate regulation that recognises the capacity constraints of smaller firms.

- Raise the threshold for small sites – A further 19% argued that revisiting site-size thresholds could provide meaningful relief for SME builders, encouraging more development of smaller-scale projects.

Encouragingly, as highlighted earlier in this report, the Government has already taken steps to address several of these issues, particularly those relating to planning. While these initiatives are welcome, their ultimate impact will depend not only on the scope of the reforms but also on the speed with which they are implemented.

Timely delivery will be critical to ensuring that SMEs experience meaningful improvements in the near term, rather than being constrained by delays that risk undermining confidence and investment.

Other recommendations put forward by respondents are as follows:

- Building Safety Levy (BSL): Respondents strongly urged Government not to introduce the BSL, warning that it would have a disproportionately negative impact on SMEs. At a minimum, they recommended proceeding with proposals to exempt small and medium-sized sites from the Levy.

- Estate management: Introduce common adoptable standards and mandate the adoption of public amenities on private estates, in line with the Competition and Markets Authority’s recommendations. This would help reduce ongoing burdens on both developers and homeowners.

- Infrastructure connections: Minimise the costs, delays, and uncertainty associated with utility and infrastructure connections – particularly electricity grid access and wastewater connections – which respondents identified as recurring barriers to timely delivery.

“There should be a standardised government set rate across the country for CIL. In our high value area it is £320 per sq m which coupled with BNG is preventing a lot of small sites coming forward”

– Survey respondent

Conclusion

While SME developers continue to face a wide range of challenges, the sector has consistently demonstrated resilience, innovation, and a strong desire to play a bigger role in meeting the country’s housing needs.

With the right support, SMEs have the potential to deliver significantly more homes, diversify the market, and bring forward the smaller sites that larger developers often overlook. If Government can act decisively to remove the barriers identified in this report, SMEs will not only have the will but also the capability to step up delivery and make a lasting contribution to solving the housing crisis.