Last updated: 17 Dec 2025

Payback Time

Analysing Exchequer returns from the Help to Buy scheme

Downloads

Payback Time

Contents

- Summary

- Part 1: Return on HMG investment: Repayments of equity loans

- Part 2: Help to Buy, what preceded it and the scheme's performance

Summary

- During 2024/25, profit on repaid Help to Buy loans passed £1bn – a 10% uplift on original loan values

- Through a combination of positive returns on equity loans and interest income, the government has now received £1.38 billion in profit from the scheme

- £304.8 million positive return on investment recorded in 2024/25 alone, an 18.6% uplift on the original value of the loans repaid during the year

- When combined with interest income, the Help to Buy scheme generated £1.2 million of profit per day for taxpayers during 2024/25

- 47% of the 387,000 loans originated through the scheme now fully repaid

Redemption rate

- 181,437 of the 387,272 Help to Buy loans originated have now been fully repaid (47%)

- 62% of loans originated before April 2020 have been repaid.

Uplift on loan values

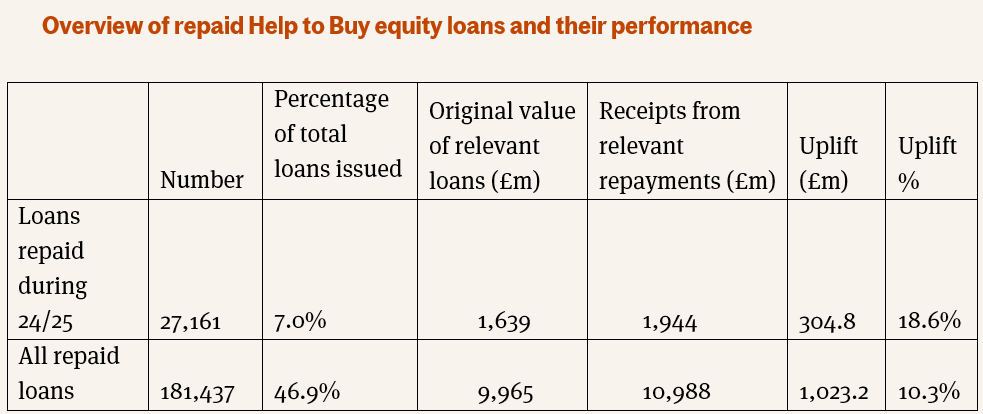

- At the end of March 2025, 181,437 loans with an original value of £9.96 billion had been repaid, generating £10.99 billion in income, an uplift of £1.02 billion (+10.3%). The previous results covering the period from the start of the scheme to March 2024, had recorded an overall uplift of 8.6%

- The average uplift on all loans repaid to date is £5,639 per loan.

- 27,161 loans with an original value of £1.64 billion were repaid during 2024/25, generating income of £1.94 billion, an uplift of £304.8 million (+18.6%)

- The average uplift for the Exchequer on each loan repaid during 2024/25 was £11,222 per loan.

Interest

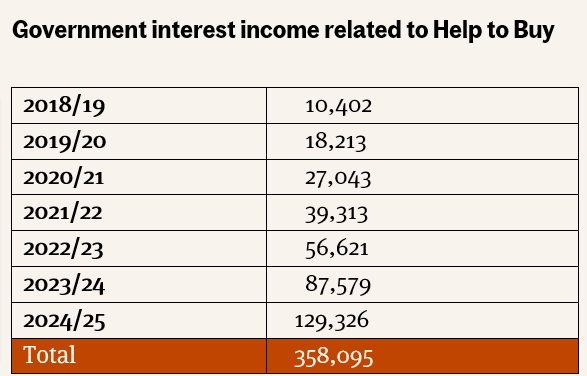

- Equity loans have so far attracted £358.09 million in interest payments

- During 2024/25, the Exchequer received £129.33 million in “homeowner fees” related to the Help to Buy scheme. This was an increase of 48% on the amount received during 2023/24 (£87.6m)

Total returns

- Combined interest payments and positive returns on loans against their original values gives a total ‘profit’ from the scheme of £1.38 billion.

- Last year, through a combination of interest income and positive returns on repayments, Help to Buy generated £434.1 million in profit for taxpayers, the equivalent of £1.2 million per day.

Part 1: Return on HMG investment: Repayments of equity loans

Redemptions

Part 1: Return on HMG investment: Repayments of equity loans

Redemptions

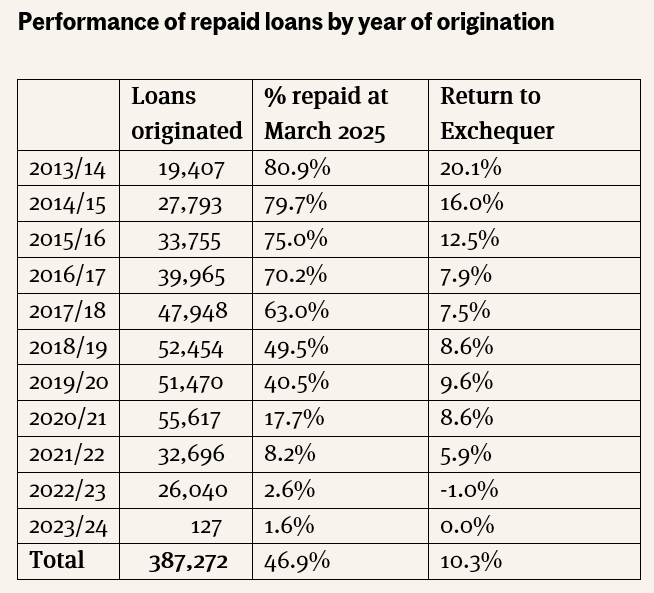

Figures for Help to Buy redemptions are only published once per year as part of Homes England’s annual accounts and have never been actively publicised by Government. The latest redemptions report, covering the period up to end of March 2025, confirms that as of that date 181,437 equity loans had been fully paid off by homeowners. This represents 47% of all Help to Buy loans originated between 2013 and 2023. This figure rises to 54% when considering only those Help to Buy equity loans that are more than four years old.

The vast majority of loans issued during the early phases of Help to Buy are now repaid. Of the 221,322 equity loans originated before 31 March 2019, 147,393 (67%) had been fully redeemed at 31 March 2025, including three-quarters of the earliest loans originated between April 2013 and March 2017.

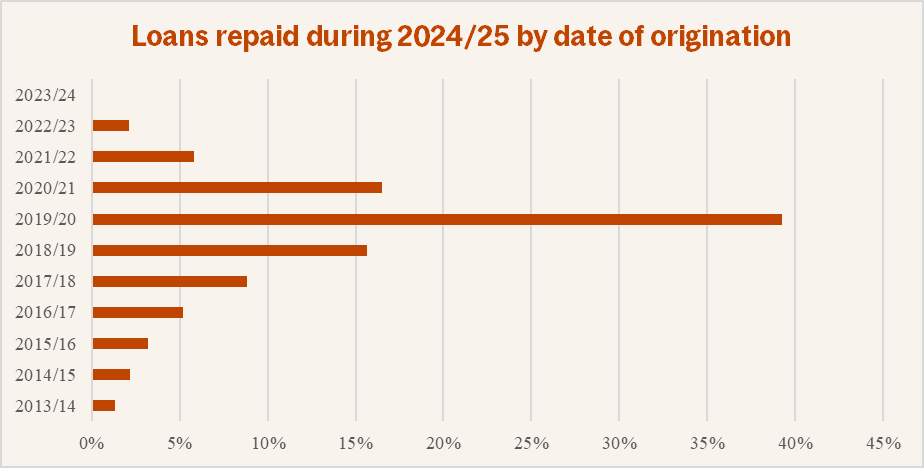

In the most recent period for which figures are available (the 12 months up to end of March 2025), 27,167 equity loans were repaid. This represented 7% of the entire loan book originated by HM Government through the scheme. Just under 4 in 10 of the loans fully repaid during 2024/25 were originated in 2019/20.

Loan redemptions in 2024/25 generated a return on investment of 18.6% compared with the original loan values involved representing a ‘profit’ of £304.8 million on those 27,161 loans, or around £11,200 per loan.

The 27,161 equity loans repaid in 2024/25:

- Had an original loan value of £1.639bn (£60,332 per loan); but

- A redemption value of £1.944bn (£71,554 per loan).

This takes the total uplift on redeemed loans to £1.023 billion (+10.3% on original loan values), or around £5,640 per repaid loan.

7. The 181,437 loans repaid to date:

- Had an original value of £9.965bn (£54,923 per loan); but

- A redemption value of £10.988bn (£60,562 per loan).

Across the lifetime of the Help to Buy scheme, equity loans with a total value of £24.7bn were originated to support 387,000 households into a new home meaning that by value, 40% of the loan book has been redeemed, but the redemptions to date have recouped 44% of the original investment.

Return on HMG investment: Interest income

In addition to the returns on equity loans themselves, the Help to Buy book is now accruing growing interest payments. In total to date, the Exchequer has received more than £350m in interest income related to the scheme, including almost £130m in 2023/24.

Total returns: combined income from redemptions and interest payments

Combining uplifts on equity loans with interest income, provides a useful combined figure for total Exchequer ‘profit’ on the Help to Buy scheme. In total, the £1.02bn of positive returns on loans, when combined with the growing annual interest income, confirms that:

- Taxpayers have seen positive returns on the scheme of £1.38 billion

During 2024/25, Help to Buy generated £434.1 million in profit for the Exchequer, equivalent to £1.2m of positive return on investment each day of the year.

Part 2: Help to Buy, what preceded it and the scheme’s performance

Home ownership schemes before Help to Buy

The Help to Buy scheme followed a series of initiatives from different governments aimed at supporting first-time buyers onto the housing ladder and into new build homes. Policy interventions to promote and support home ownership had been a feature of the policy landscape and the housing market from the 1960s up to 2023.

During the 20th Century, the focus of these initiatives was largely focused on tax reliefs for mortgage payers. In 1967, Government introduced the Option Mortgage Scheme. The scheme gave homebuyers the choice of either tax relief on mortgage interest payments or a Government subsidy to reduce the interest rate on the mortgage. This was intended to support households who did not pay tax and would be unable to benefit from more common tax relief schemes.

In 1978, Government introduced Mortgage Interest Relief at Source (MIRAS). For a time Dual MIRAS allowed two homeowners to claim double relief. By 1985/86, the scheme came at a cost of £4.75bn per year (Hansard, 12 May 1986: Col. 341). This is equivalent to around £15bn per year in 2024 prices.

The Right to Buy was an exception to the 20th Century orthodoxy around mortgage interest reliefs with a major government drive to discount council homes for tenants. With more than one million such transactions, the Right to Buy can be seen as the UK policy intervention that created the biggest surge in home ownership, but with no supply-side component the scheme merely saw the transfer of a large proportion of housing stock from one tenure (social rented) to another (owner occupation).

With this experience in mind and with a growing understanding of the emerging housing supply and affordability crises, around the turn of the millennium attention turned to directing home ownership support to delivery of new housing. Assisting first-time buyers and key workers onto the housing ladder would also help to stimulate housing supply by addressing the lack of higher loan-to-value mortgage lending on new build housing. The dearth of high LTV mortgages for new properties was exacerbated by a planning policy that promoted delivery of apartments over houses but with restricted mortgages available for new apartments.

The 2000s saw the focus turn to supporting first-time buyers to purchase new build homes with Government seeking to tie home ownership to economic growth and regeneration while guarding against pure demand-side stimuli. Indeed, it was during this time that the already significantly scaled down MIRAS was phased out.

The problem being solved by the 2000s was the discrimination against new build lending in the mortgage sector and a desire from the government of the day to increase home building rates. In short, the reliance on the mortgage market – and specifically the new build mortgage market, makes new housing supply even riskier than it would otherwise be and creates additional risks when weighing up investments.

Between 1999 and 2012, the government, often in partnership with house builders, unveiled equity loan schemes, share equity initiatives and mortgage guarantee schemes. These included the First-Time Buyers Initiative, HomeBuy Direct, FirstBuy and NewBuy alongside similar schemes with particular focuses like the Rent to HomeBuy and Social HomeBuy schemes.

These schemes varied in theme with several focusing on key workers, but broader based schemes such as Homebuy Direct had at their core a shared equity arrangement with developers and government sharing the upfront costs. These were relatively modest in scale and the upfront capital requirements (often 5% or more of the sales price) meant that for developers these initiatives were the preserve of those companies with sufficient balance sheets, usually the largest 25-35 builders.

Help to Buy inception

Announced at the 2013 Budget, by then Chancellor, George Osborne, the Help to Buy Equity Loan Scheme was established to accelerate the recovery of home building and improve the mortgage deposit and affordability prospects of first-time buyers following the Global Financial Crisis of the late 2000s.

By 2013, with few mortgage lenders offering Loan-to-Values on new build homes of more than 85% on houses and 80% on flats, investment in new housing schemes was minimal. With more than four in five home builders citing mortgage affordability and availability as a ‘major barrier’ to housing delivery, the scheme was designed to bridge the deposit gap for homebuyers while also improving affordability calculations for households applying for mortgages.

The three objectives of the scheme communicated by the Government at the time were:

- Increase the supply of low-deposit mortgages for creditworthy households

- Increase the supply of new housing

- Contribute to economic growth

The scheme granted an equity loan worth up to 20% (40% in London from 2016 onwards) of the value of a new build home up to an initial maximum purchase price of £600,000 across England, whilst the buyer provided a deposit of at least 5% and a mortgage from a main lender of up to 75% (55% in London). The loan is interest-free for five years, after which interest payments are due. The scheme’s final two years, from April 2021, became exclusive to first-time buyers and switched to regional price caps with greater emphasis on supporting purchasers in London and Southern England.

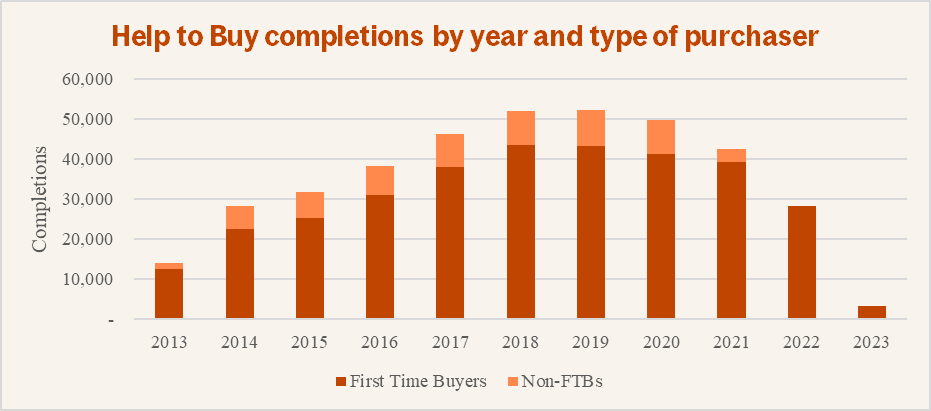

By the time the scheme formally closed down, it had supported 387,195 households, including 328,346 first-time buyer households, to buy new build homes.

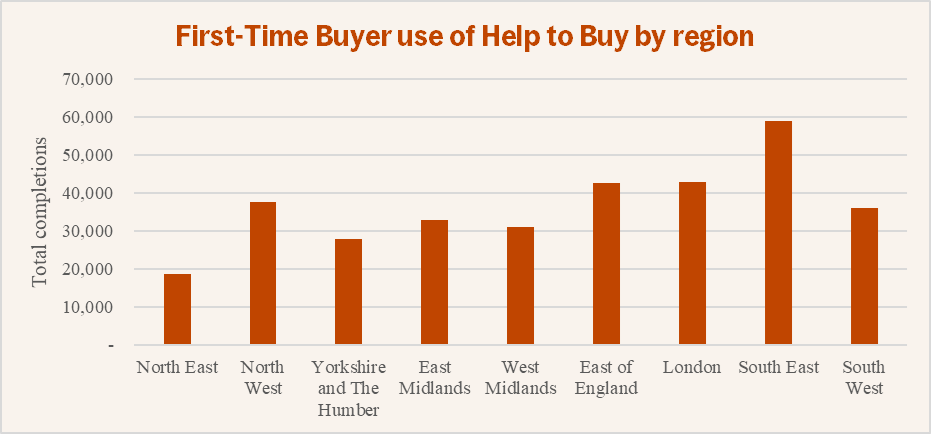

Help to Buy had broad appeal across all regions of England with no single region responsible for more than 18% of first-time buyer purchases through the scheme.

The 2021-23 Help to Buy scheme

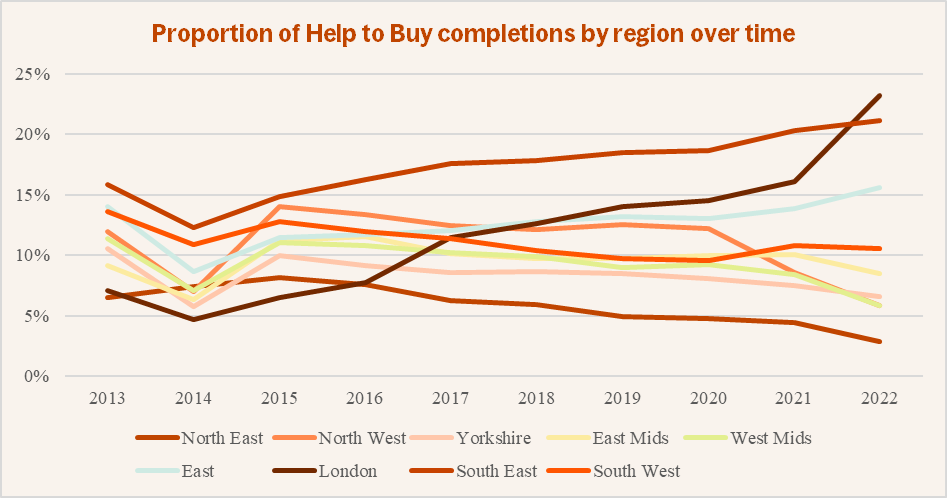

At Budget 2018 the then Chancellor, Philip Hammond confirmed that the original version of the Help to Buy scheme would be replaced in 2021 by a two year initiative. The new 2021-23 Help to Buy scheme was characterised by (i) first-time buyer exclusivity and (ii) regional price caps ranging from £186,100 in the North East to £600,000 in London. The new price caps were based on a multiple of average FTB prices and introduced restrictive price caps in northern regions.

This tied in neatly with the prevailing Government and Homes England drive at the time to direct a greater proportion of housing investment in areas and regions where housing affordability was most stretched. The consequence has been a significant reduction in the proportion of Help to Buy completions recorded in Yorkshire, the North West and the North East. These three regions had accounted for 26% of all HtB transactions in 2019, but this had fallen to 15% by 2022. The proportion of HtB transactions across the two midlands regions fell from 19% in 2019 to 14% in 2022.

The chart below shows the changing regional split of HtB transactions over time. The initial rise in London from 2016 is accounted for by the then Chancellor, George Osborne’s decision to increase the maximum equity loan value in London from 20% to 40%.

Impact on supply

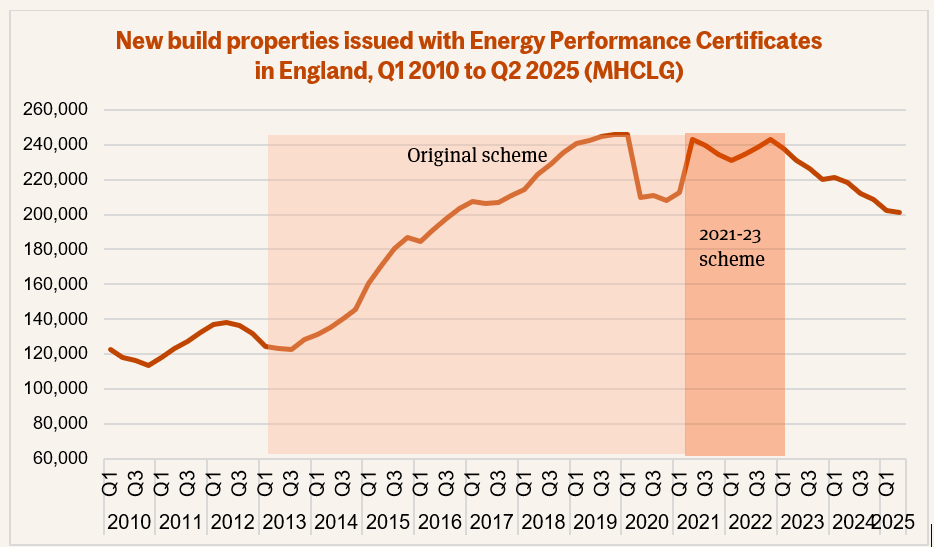

Although not exclusively attributable to the introduction of Help to Buy the impact of the scheme on housing supply in England is plain to see. By 2013, underlying economic indicators had already been going in the right direction for several years and (modest) growth in the economy had returned. However, housing supply had reached its peacetime nadir only in 2012/13 with 124,000 net additions recorded (136k gross). But despite the wider factors broadly tracking positively, homebuyers struggled to find affordable mortgage finance suitable for new build properties.

Critics of Help to Buy argued in the first couple of years of the scheme’s operation that it was having little impact on supply but by 2015 the additional confidence it had injected into the market and the strong forward visibility it created for builders, meant that land acquisition and investment in labour and skills eventually came to fruition.

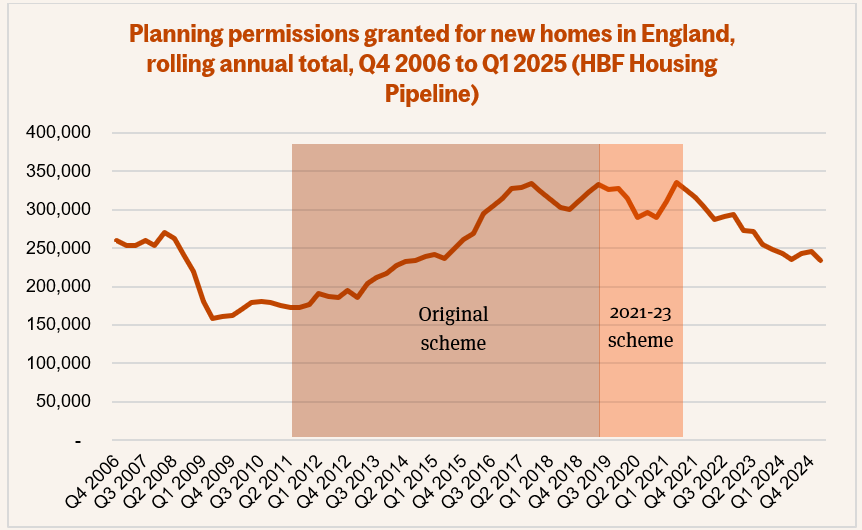

Planning permissions immediately started to increase as a result. Prior to the 2013 Budget, the number of units being approved in a 12-month period was around 185,000. By early 2015, this annualised figure exceeded 250,000. The trend continued throughout the first phase of the Help to Buy scheme, climbing to more than 330,000 at the peak – an 80% increase on the pre-Budget number.

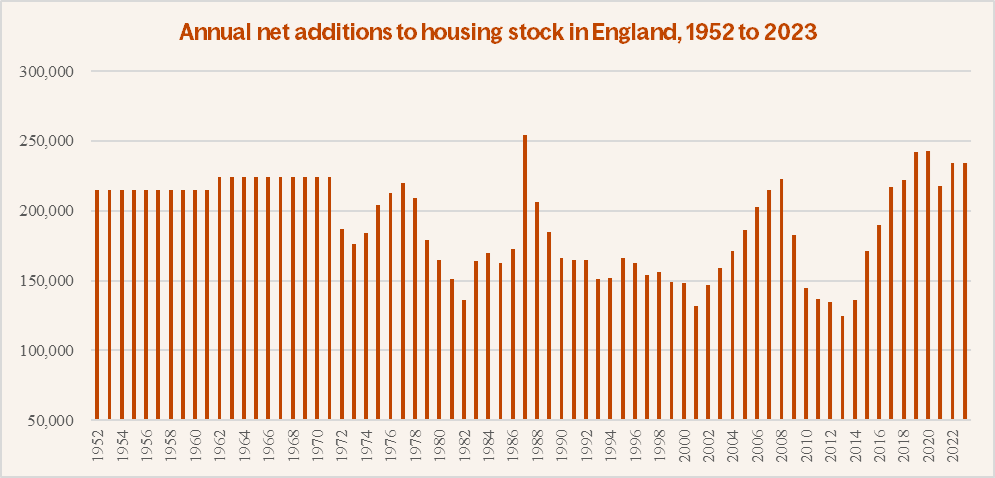

By 2018, five years on from its introduction, housing supply in England had doubled. As sales increased, initially by around 40-50%, home builders who had taken a conservative approach to land acquisition and investment in preceding years found themselves building out their sites more quickly (where they could find adequate labour) and expanding their footprints. The combined effect of higher sales rates and more sales outlets drove what became the fastest increase in housing supply since the years after the Second World War.

In contrast with the period between 2008 and 2013, where mortgage availability for new build purchasers was frequently among the top barriers to delivery, almost immediately after the scheme was introduced, availability and cost of mortgage finance barely registered as a barrier to growth in home builder surveys.

The near doubling of housing supply in the five years after the scheme was unprecedented over the past 75 years. From the lowest housing output on record in 2012/13, the Help to Buy scheme, along with the reformed planning system, the National Planning Policy Framework, supported seven years of year-on-year increases in delivery to sustained levels of Net Housing Supply not seen in England since the Second World War. Although the 1950s and 1960s saw many more new homes built, the level of demolitions, often running at more than 50,000 per year was a considerable offset. The housing crisis of the post-war period was a very different one to today’s as it was far less about land availability and affordability and more about post-war rebuilding and renewal of housing stock.

Economic activity

The third objective set by the Government for the scheme was to generate economic activity. The home building industry is a major contributor to GDP and economic growth, and the increases in housing supply as a result of Help to Buy have supported this.

The 387,000 Help to Buy purchases supported:

- £86 billion generated in economic activity

- Over £10 billion in tax receipts

- More than 130,000 jobs supported each year at its peak