Last updated: 17 Oct 2025

Mind the Gap

Examining recent housing supply and affordability data in London, setting out the scale of the challenge for the Government and Mayor of London if they are to achieve their targets, and outlining recommendations to get London building again.

Downloads

Mind the Gap

Contents

- Introduction

- Housing supply trends

- Housing affordability

- Causes of undersupply in London

- Recommendations

Introduction

The Government has set an ambitious target of delivering 1.5 million new homes over the next five years. Achieving this ambition is impossible without a significant increase in housing delivery in London, where a quarter of the total – 440,000 homes - are expected to be built.

However, over the past year, planning permission approvals in the capital have fallen to record lows, while housing delivery is declining year-on-year. To meet the Government’s target, housing supply in London needs to more than double from current levels in the years ahead.

The capital is also experiencing a sharper drop in both housing completions and planning permissions approvals than the rest of the country. In 2023/24, the number of new homes delivered in London fell by 9% year-on-year, compared to a 5% decline in the rest of England.

A combination of issues - the Section 106 Affordable Housing market, weak effective demand from first-time buyers, pressures on viability, and planning delays - are holding up development across the country, including in the capital. In addition, developers in London are disproportionately affected by Building Safety Regulator-related delays, recent changes to Building Regulations, increased cost burdens on brownfield development, and some of the requirements set out within the London Plan. Collectively, these challenges risk bringing development in London to a complete halt.

Worryingly for anyone with an interest in boosting home building in the capital, numerous policy changes and taxes are being introduced by central government, including the controversial Building Safety Levy, which, because of how it is levied, will disproportionately squeeze the viability of new housing delivery in London.

The Government and the Mayor of London must act urgently to address these barriers if they are to achieve their housing ambitions for the capital.

This report from the Home Builders Federation (HBF) looks at the recent housing supply and affordability data in London, setting out the scale of the challenge for the Government and Mayor of London if they are to achieve their targets, and outlines a series of recommendations to get London building again.

Housing supply trends

The crisis in housing supply and affordability continues to deepen in London. According to the latest figures from the Ministry of Housing, Communities and Local Government (MHCLG), only 32,000 new homes were delivered in London in 2023/24, down 9% on 2022/23 and 30% below the recent 2019/20 peak. Housing delivery is now at its lowest level in a decade.

Indicators of supply

London’s share of national housing output is also falling. For instance, London accounted for 20% of all new homes delivered in England ten years ago, compared to only 15% today. This is despite the Government’s ambition for London to deliver 24% of all new homes nationally - a share not achieved in the past two decades.

Furthermore, as HBF/Glenigan data shows, a decade ago, just under a quarter of all planning permission approvals for new homes in England were granted in London. Over the past year, that figure has fallen to 18%.

Reversing these downward trends will require a substantial change in the overall policy environment if investment is to be drawn back into the capital in the years ahead. However, all available indicators suggest that supply will continue to fall in the coming months and years:

- Energy Performance Certificates (EPCs) for new homes, a strong proxy for recent new build housing supply, are decreasing. In the year to June 2025, EPC registrations for new build homes in London fell to around 30,500 homes, down 12% on the year to June 2024. This is the lowest for a 12-month period since the year to March 2015.

- The Greater London Authority’s (GLA) residential starts dashboard shows that the number of commencements on site for new homes fell by 38% between 2022/23 and 2023/24.

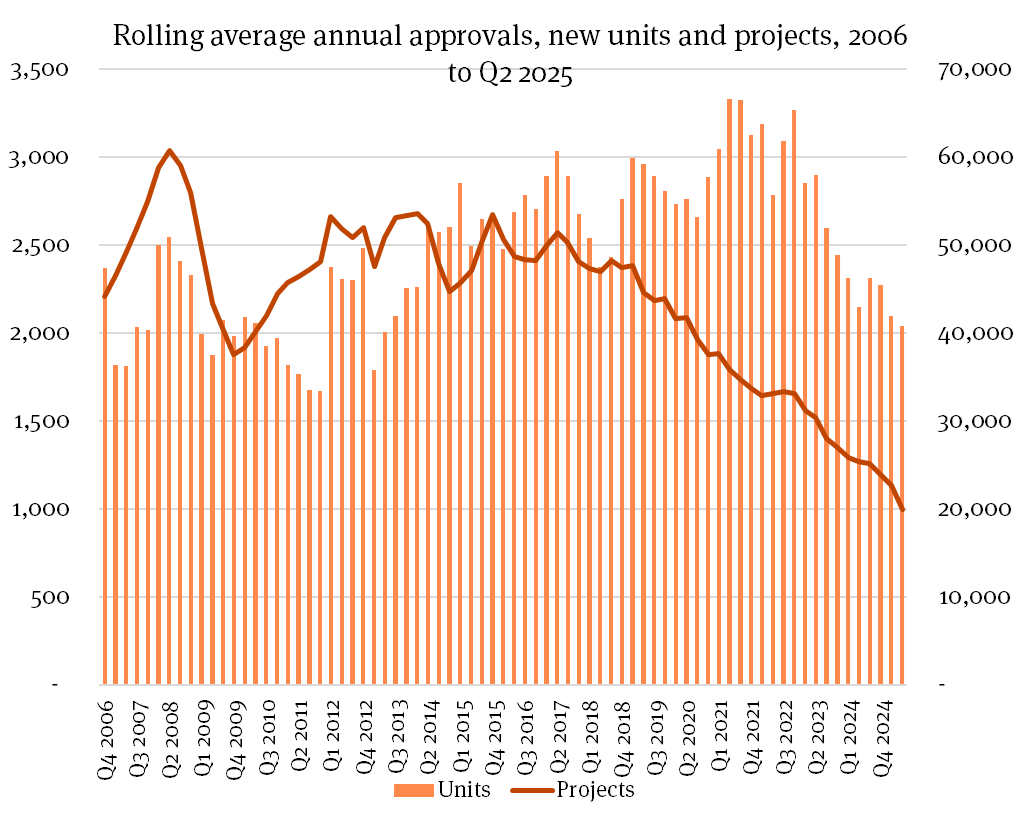

- Planning permissions approvals for new projects in London, a lead indicator of future supply levels, have been on a steep downward trajectory since 2019. The number of projects granted approval in London in the 12 months to June 2025 was 996 – the lowest 12-month period since records began in 2006.

- In the 12 months to June 2025, just 40,800 new homes were granted planning permission in the capital. This is 5% lower than the year to June 2024.

Standard Method

The new Standard Method requirement for London also illustrates the scale of the challenge. By way of background, the Standard Method is a government-set formula which calculates the minimum number of new homes needed annually to meet housing need, based on both household growth projections and affordability pressures.

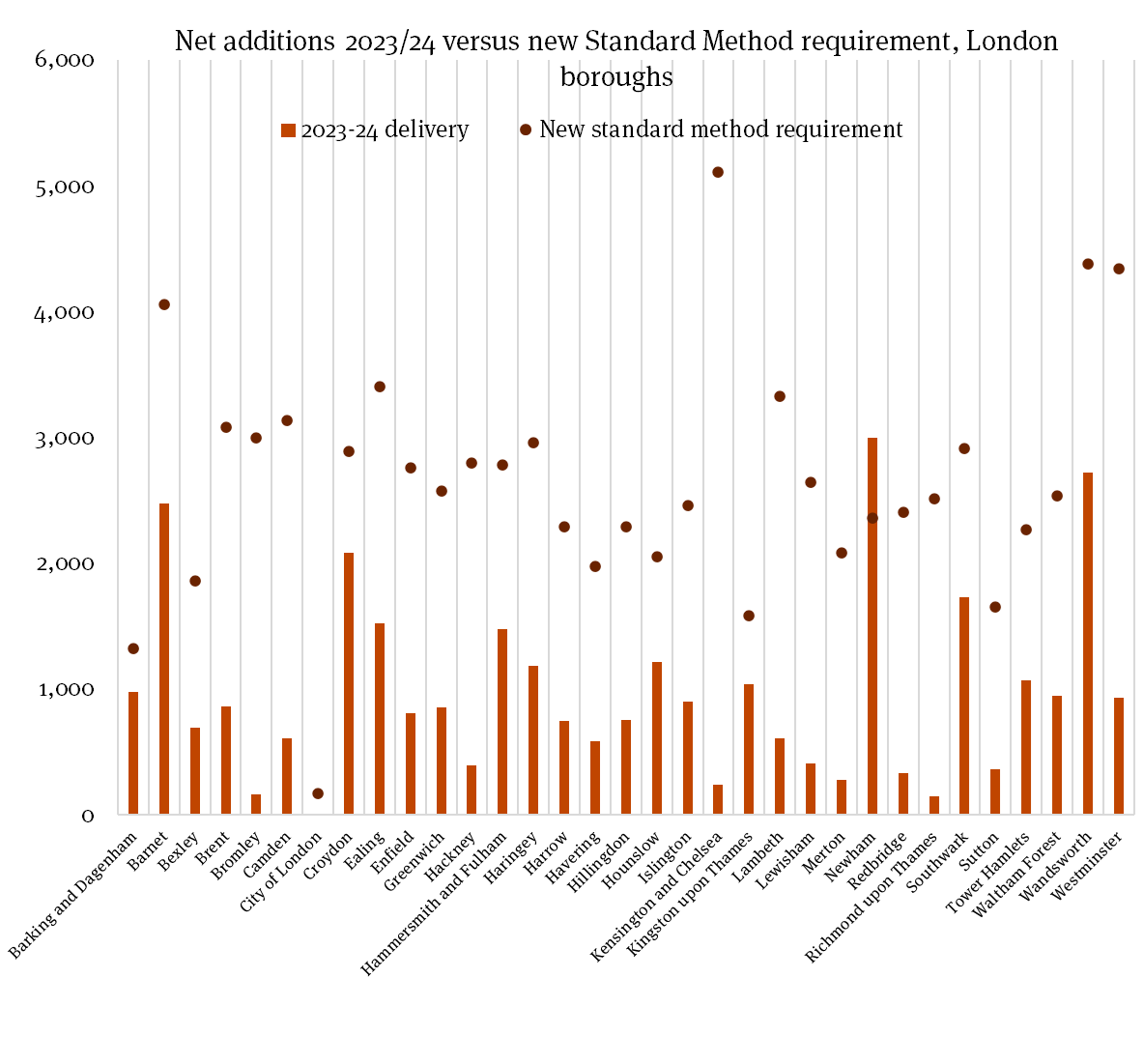

The new Standard Method requires London to deliver 88,000 homes a year. However, meeting this new target will be extremely challenging for two reasons. Firstly, the Standard Method has not yet been embedded in the London Plan, as this will only happen when a new plan is adopted, potentially in 2027. Until then, local plans will not make provision for the higher requirement. Second, achieving the target would require a 175% increase on current delivery rates, an unprecedented level of growth.

It is worth noting that, at the borough level, the Mayor will distribute the 88,000-home target across London’s Local Planning Authorities (LPAs), including the Mayoral Development Corporations, in the next London Plan. Nevertheless, in the meantime, using the individual Standard Method figures for each of the 32 boroughs and the City of London provides a useful proxy for what each individual borough will need to provide in the future. On this basis, very few boroughs are currently delivering at the levels required, and only the London Borough of Newham exceeded its new Standard Method requirement in the 2023/24 financial year.

Household projections

Delivery is also failing to keep up with new household formation. The number of households in London is expected to grow by 1.4 million by 2039, compared to 2014 (the baseline year for both ONS projections and the Standard Method), a 40% rise. This requires an average of 56,000 new homes per year during this period just to keep up with projected household growth alone, on top of the pre-existing shortfall.

However, since 2014, London has delivered an average of 38,000 new homes a year, just 68% of what is required. This means that there is already a backlog of 176,000 homes needed to meet demand generated by new households formed over the past decade - even before accounting for the need to address affordability pressures and housing shortfalls that predate 2014.

Housing affordability

The consequence of this persistent undersupply of new homes is that housing has become steadily more unaffordable over several decades, pushing more and more households into temporary accommodation and locking younger generations out of home ownership. The average age of a first-time buyer in London has risen from 32 to 35 in the past 20 years.

HBF research into the affordability of housing for first-time buyers also shows that:

- First-time buyers in London would have to save 50% of their discretionary income for over 13 and a half years to save the necessary deposit for a new home.

- Average deposits in London are 681% of annual income after bills.

England was 3.5 compared to 4 in London. As of 2024, however, the ratio in London was 11, and 7.7 in England. Furthermore, only three of London’s 33 local authorities now have an affordability ratio less than 10.

Furthermore, the average first-time buyer property value in London is now 17 times the average annual net salary for 22-29 year olds.

The impact of this worsening affordability is clear in the data from the English Housing Survey:

- 32% of all households in London now privately rent, compared to 14% 20 years ago, as fewer households can get onto the housing ladder. Meanwhile, the proportion of households owning a home with a mortgage has dropped from 39% to 25% in the past two decades.

- In 2023-24, 15% of first-time buyers bought a property in London, whereas 85% bought a property outside of London. However, in 2013-14, a quarter of first-time buyers bought in London and the remaining 75% in the rest of England.

- The proportion of households containing someone who could not afford to rent or buy elsewhere was highest in London, at 8%, compared to 4% in the North East.

Causes of undersupply in London

The Government’s efforts to reform the planning policy framework over the past year have laid some important groundwork for increased housing delivery. However, significant barriers remain across the country that must be urgently addressed if the target of 1.5 million new homes is to be met, including the 440,000 homes that must be delivered in London.

Chief among these are weak effective demand from first-time buyers, pressure on viability due to additional policy costs, and persistent delays within the planning process. Recent policy choices, such as build-out transparency proposals and the decision to press ahead with the Building Safety Levy, risk further undermining progress and should be reversed.

As well as these wider challenges, developers in London are also being disproportionately affected by a range of other barriers:

Building Safety Regulator

The requirements of the Building Safety Act 2022 and the performance of the Building Safety Regulator (BSR) that became operational in October 2023 are critical issues which have significantly impacted investment in new homes in London. As a result of delays caused by the lack of capacity within the BSR, builders and investors are now increasingly electing not to build high-rise schemes due to the timescales involved, driving investment away from new high-rise buildings in London.

BSR data shows that around 10,000 homes have been awaiting Gateway Two approval – one of the critical checkpoints before a development can proceed – for more than 26 weeks.

HBF has been actively engaged with the BSR to support it with information and data, and has been calling for a significant streamlining of processes and a substantial resource injection to make the BSR’s caseload more manageable.

The recent changes to the BSR’s leadership and processes announced by the Government will hopefully help to ease the current blockages, and the industry is committed to collaborating with the new leadership as it tackles the significant challenges ahead. If they are successful in making the BSR more functional and efficient, this will not only uphold building safety but also ensure high-rise and urban development can be delivered at the levels the Government wants to see in London.

Higher-rise buildings

BSR delays are not the only reason why high-rise buildings are becoming significantly less attractive investments. A range of additional changes to Building Regulations in recent years has significantly increased delays and costs in gaining planning approval. For instance, dual staircases are now required in buildings of 18 metres or six stories. While a well-intentioned policy, the Government’s own research suggests that second staircases do not substantially aid evacuation. Furthermore, the policy has ultimately added thousands of pounds to the cost of each flat, while reducing saleable floor area – and thus making high-rise buildings increasingly unviable and unappealing for investment.

The introduction of the Mayoral Community Infrastructure Levy and the forthcoming Building Safety Levy, which are both levied based on floor area, are further penalising the development of high-rise buildings, as well as the reduced first-time buyer market, which tends to buy flats in greater numbers.

As a result of these challenges, EPC registration data shows that the number of new flats delivered in London is declining. Around 29,000 new flats were registered in the capital in the 12 months to June 2025, compared to around 33,000 in the year to June 2024.

London Plan: Additional policies

The current London Plan includes 88 additional policies which apply in some way to residential schemes. These individual policies can be lengthy and detailed in and of themselves, without taking into account the significant amount of supplementary guidance that has also been published.

When considering that the London Plan sits alongside policies set out in borough local plans, as well as the accumulation of national policy costs and requirements, the policy landscape facing developers in London is more complex and unwieldy than anywhere else in the country. This has had the effect of suppressing development, either by further challenging viability and deterring new developments from coming forward, or because navigating the additional policies causes delays to work beginning on site. The London Plan Review, published in 2024, found that it took seven weeks longer to determine major residential applications than those decisions in the next four largest cities.

The duplication of energy standards within the London Plan is a particular issue. Meeting London Plan energy requirements, beyond current Building Regulations, adds significant costs per unit, with additional policies on carbon targets, energy statements, and overheating. Large carbon offset payments are also required to bring schemes to an overall net-zero position under the London Plan, penalising almost all developers financially for not meeting an extremely challenging target. In some boroughs, carbon offset payments alone can reach £3,000 per home, based on £95/tonne over 30 years. Given that the Government’s Future Homes Standard is already world-leading, the national standards are sufficient for ensuring new homes contribute towards net zero ambitions.

The new London Plan, which is being prepared, should be a shorter and more focused document, in line with the Government’s broader ambitions for new Spatial Development Strategies. We welcome the acknowledgement that the new London Plan will not add to policy requirements, but streamlining or deferring of existing policies must also be considered.

London Plan: Affordable Housing requirements

London’s current 35% Affordable Housing requirement is proving increasingly unsustainable. While the policy is well-intentioned, in practice, it is a major barrier to delivery and contributes to a situation in which few homes of any tenure are being delivered.

For instance, very few sites can now follow the Fast Track Route available for those able to meet the 35% requirement, with this requirement simply not being viable on most sites. As a result, the policy forces almost all schemes to undergo viability testing, adding significantly to delays experienced by housebuilders.

Furthermore, since 2017, when the policy was introduced, the overall national policy context and the costs of development have shifted considerably. Additional policy costs since then include Biodiversity Net Gain, the Residential Property Developers Tax (RPDT), and increases in water and sewerage infrastructure charges. All of this has ultimately eroded the ability of housebuilders to deliver new Affordable Housing at such high levels without compromising the viability of their schemes altogether.

Looking ahead to the next London Plan period, the Building Safety Levy, Future Homes Standard and potential Landfill Tax changes will add additional policy costs, further reducing the financial headroom for delivering the Mayor’s 35 per cent policy.

The industry’s ability to meet this target is also severely hindered by the lack of bids from Registered Providers (RPs) for Section 106 Affordable Housing units – an issue that is becoming ever more pressing. A recent Freedom of Information request of local authorities carried out by HBF suggests that around 8,500 housing units, either currently under construction or set to begin construction within the next 12 months, do not have an RP buyer, with thousands more homes planned in the coming years also uncontracted. An additional 100,000 private homes are stalled or delayed because of the issue.

The policy must now urgently evolve to reflect these new realities, with increased flexibility - particularly regarding tenure mix - required.

First-time buyer demand

High interest rates, the end of the Help to Buy equity loan scheme in 2022, and rising deposit requirements have made it harder than ever for first-time buyers to get on the housing ladder. According to recent HBF research, only the top 30% of earners are now able to purchase their first home. These challenges have had a significant knock-on effect on overall housing supply, as first-time buyers are a vital component of the overall market.

The closure of Help to Buy was particularly detrimental to industry confidence in London. The scheme had a clear positive supply-side impact in the capital, giving home builders greater confidence to invest in new sites. For instance, in the 12 months before its launch in 2013, around 11,000 units were approved in London. While other factors played a role, the introduction of Help to Buy coincided with a near 50% increase in approvals for new units, reaching over 16,000 by early 2015.

Take-up of the scheme in London was also especially high, reflecting high levels of pent-up demand. 43,000 first-time buyer households used Help to Buy in the capital over its lifetime, more than any other region except the South East. Furthermore, by the scheme’s final year, when regional price caps were in place, London accounted for 24% of all Help to Buy completions. First-time buyers also represent a larger share of the potential market in the capital - around half of sales, compared with a third across the rest of England.

In turn, it is no coincidence that supply in the capital has fallen since the scheme’s withdrawal, reflecting the heightened risk for home builders as the pool of potential buyers has shrunk.

Reintroducing an equity loan scheme for first-time buyers is vital to support delivery in London. Modelling by Public First suggests that, if such a scheme were introduced with a higher maximum loan available in London – as was the case under Help to Buy – it could boost supply by an additional 17,500 homes over the next five years, helping 91,000 people to buy a home in the capital.

Costs of brownfield development

Brownfield development plays an essential role in London’s housing mix, particularly in inner London, where greenfield sites are scarce. While brownfield sites alone cannot provide the homes London needs, and industry has welcomed the Mayor’s green belt review, the London Plan and national policy overall will likely continue to prioritise brownfield development.

Given this policy priority, it is concerning that these sites have become even more challenging to develop in recent years. One key reason is that, as overall policy costs have risen in recent years, the viability of brownfield development has been particularly affected, as these sites already have high upfront costs for initial remediation, such as the removal of contaminated soil.

Another challenge is the implementation of Biodiversity Net Gain (BNG) requirements. BNG requires all new developments to deliver an uplift of 10% in biodiversity value compared to before the site was developed. However, counterintuitively, the pre-development biodiversity value of brownfield sites is often higher than greenfield sites because they allow a wider range of plants and wildlife to thrive. This makes achieving a 10% net gain much more complex, particularly where there is Open Mosaic Habitat.

Furthermore, changes to Landfill Tax could present an additional challenge in the years ahead, with the proposals to move to a single rate of Landfill Tax potentially seeing costs run to an additional several thousand pounds per home. With brownfield sites having a greater proportion of concrete within the waste mix, more Landfill Tax will be paid on these sites, and as such, fewer of these sites will be viable.

There must urgently be a more joined-up approach to policy costs on brownfield sites in the round if housing delivery in London is to increase.

Grid capacity

In recent years, the delivery of new homes in some parts of London has been delayed due to concerns over grid capacity. The issue began in 2022 when residential schemes of 25 or more homes were put on hold in three West London boroughs due to a lack of electrical capacity, caused by requests from data centre operatives for new electricity connections. The issue has since spread more widely across the country.

The issue is slowing down delivery, requiring housing delivery to be phased year on year in parts of London to accommodate the capacity of the grid. Ramping solutions have been implemented on various scales in parts of London, but these are not yet enough to resolve the problem.

Research has found that energy requirements for new homes significantly overestimate how much electricity new homes use. Furthermore, energy companies have found that the growing use of EV charging and heat pumps is not increasing their peak demand as expected, due to new homes being more energy efficient. Therefore, a more realistic assessment estimates that the grid could support the delivery of 2.5 times as much housing as assumed.