Failing to act in the Spending Review will lock a generation out of home ownership

Policy and Public Affairs Manager, Laura Markus, reflects on the urgent need for the Government to use the upcoming Spending Review to tackle the deepening housing affordability crisis by introducing targeted support for first-time buyers and restoring fairness to the market.

This week’s Spending Review marks a major event in the parliamentary calendar. Almost one year on from the election, and with many sectors of the economy feeling somewhat disappointed with policy progress so far, the pressure is on for the Government to use this review to set out its plans for the remainder of the parliament and bring confidence to businesses and households.

At HBF, there are many changes we hope to see, but one area where government action feels especially urgent is support for the demand side of the housing market. A series of recent publications has underlined the deepening affordability crisis. That home ownership is becoming increasingly out of reach is no secret, but new data reveals just how severe the situation has become.

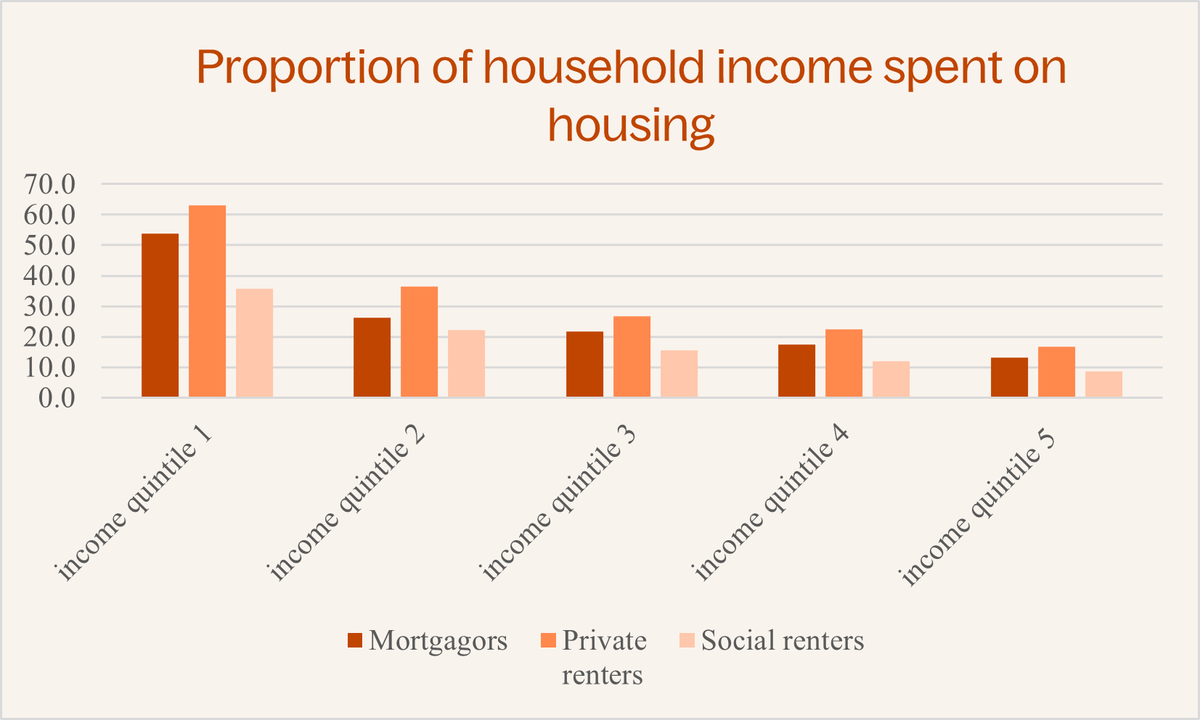

One of the clearest signs of the crisis is the proportion of income spent on housing. The latest English Housing Survey results find that, at an average of 34%, private renters spent the highest average proportion of their income on housing, followed by social renters (26%) and mortgagors (19%). In London, unsurprisingly, these costs soar higher, with renters spending 46% of their income on housing.

It becomes even more problematic when looking at the proportion spent on housing for different income quintiles. For all tenures, those in the lowest income quintile spent a greater proportion of their income on housing compared to households in the highest income quintile. In particular, private renters in the lowest income quintile spent 63% of their income on rent, significantly higher than the 17% spent by those in the highest income quintile.

Such eye-watering housing costs relative to income severely limits people’s ability to save for a deposit or secure a mortgage, effectively shutting many – especially those on lower and middle incomes, out of homeownership altogether.

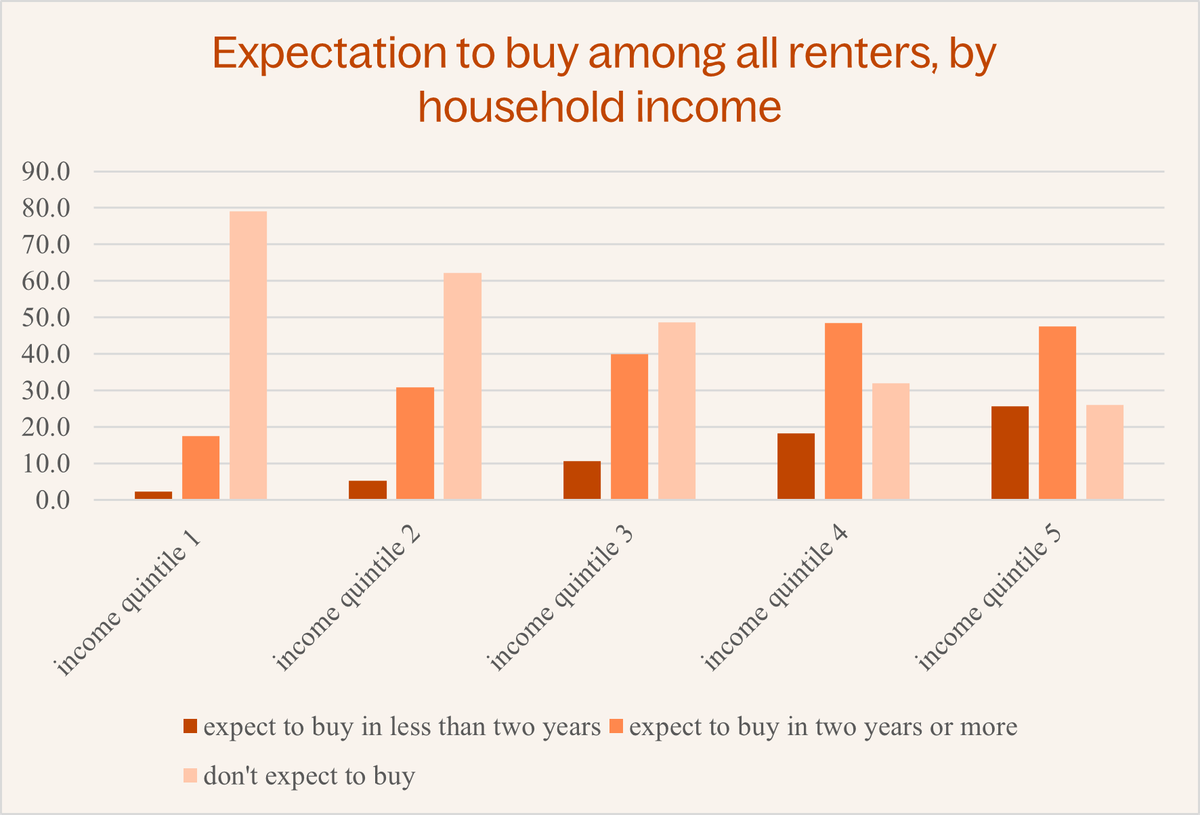

Among the lowest-income renters, 72% don’t believe they’ll ever own a home. In contrast, the majority of high-income renters are optimistic, with many expecting to buy within the next two years. This stark divide shows that home ownership is no longer a universal goal but a luxury, reserved for those with the wealth or family support to attain it.

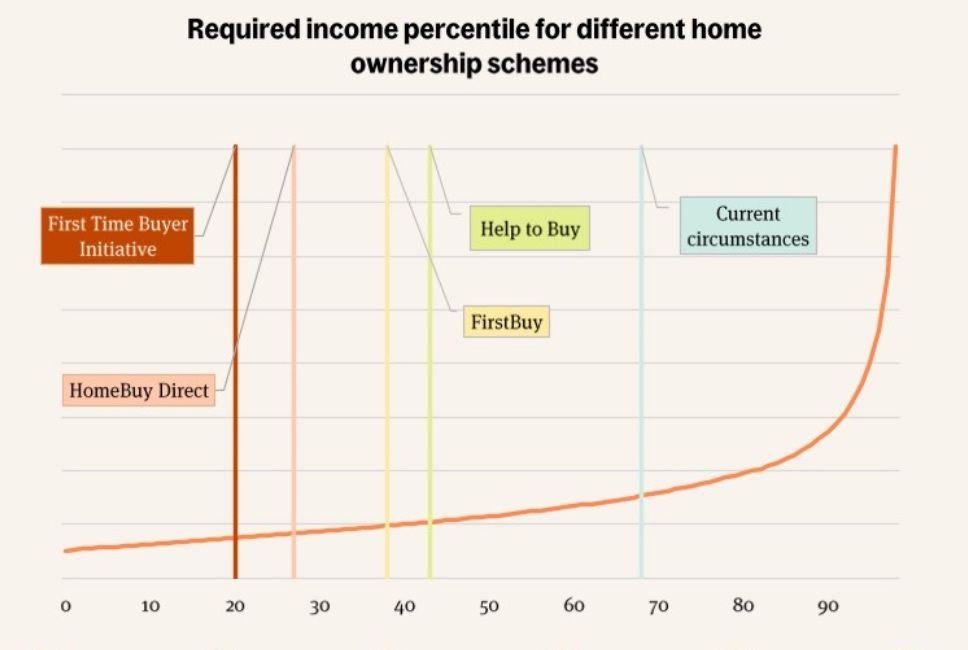

The findings of the English Housing Survey echo recent research published by HBF, which highlights how the absence of a government support scheme for prospective buyers, amidst a lack of affordable mortgage lending, is making homeownership unachievable for hundreds of thousands of would-be buyers. It is the first time in decades that first-time buyers are without support from a government initiative, and as a result, only the top 30% of earners are in a position to take a step onto the housing ladder.

The Spending Review is a prime opportunity for the Government to address this societal divide. And, with the polls already slumping, less than a year into their premiership, assisting more people onto the housing ladder would prove politically popular for the Government. A recent public opinion poll found widespread support for a government intervention that would make home ownership more accessible:

- 76% find the current situation "ridiculous." These sentiments are held strongest by Reform UK voters and Labour switchers, i.e. those who voted Labour at the 2024 General Election but now say they will vote for another party.

- Labour switchers were particularly concerned about falling rates of home ownership and most supportive of the Government doing something to help prospective first-time buyers:

- They want government policy to prioritise home ownership over rental by over two-to-one.

- They are also more likely than the general public to think falling rates of home ownership is a bad thing for the country.

- 69% of the public support a new equity loan scheme.

- Support rises to 74% among Labour switchers.

The government has an economic imperative to implement targeted homeownership schemes to assist first-time buyers, but there is a growing body of evidence to show, too, that there is a political need for this administration to maintain its home ownership commitments. The success of Help to Buy, with over a third of a million first-time buyer purchases, demonstrates just how significant an impact such an announcement could have.

At HBF, we have long urged Government to sufficiently support those looking to get onto the housing ladder. Government intervention is crucial to address this imbalance, as the market alone is failing to provide affordable options, deepening inequality and perpetuating housing insecurity for the most vulnerable. With housing affordability at a crisis point and public support for intervention clear, the case for action is stronger than ever.

The Spending Review presents an opportunity for the Government to begin the restoration of fairness to the housing market, rebuild confidence among young and aspiring homeowners, and show real commitment to addressing one of the most pressing challenges facing the country today.